In this guide

2024 UK Banking Benchmark Report

2024 UK Banking Benchmark Report

Competitive benchmarking 5 of the UK's biggest consumer banks

The quality of a digital banking experience needs to be viewed through the lens of the customer, from the first search to post-purchase customer support. Traditional metrics like NPS or CSAT only paint part of the customer experience picture. So, how do the UK’s top consumer banks stack up?

QX Score

Who is winning on digital customer experience?

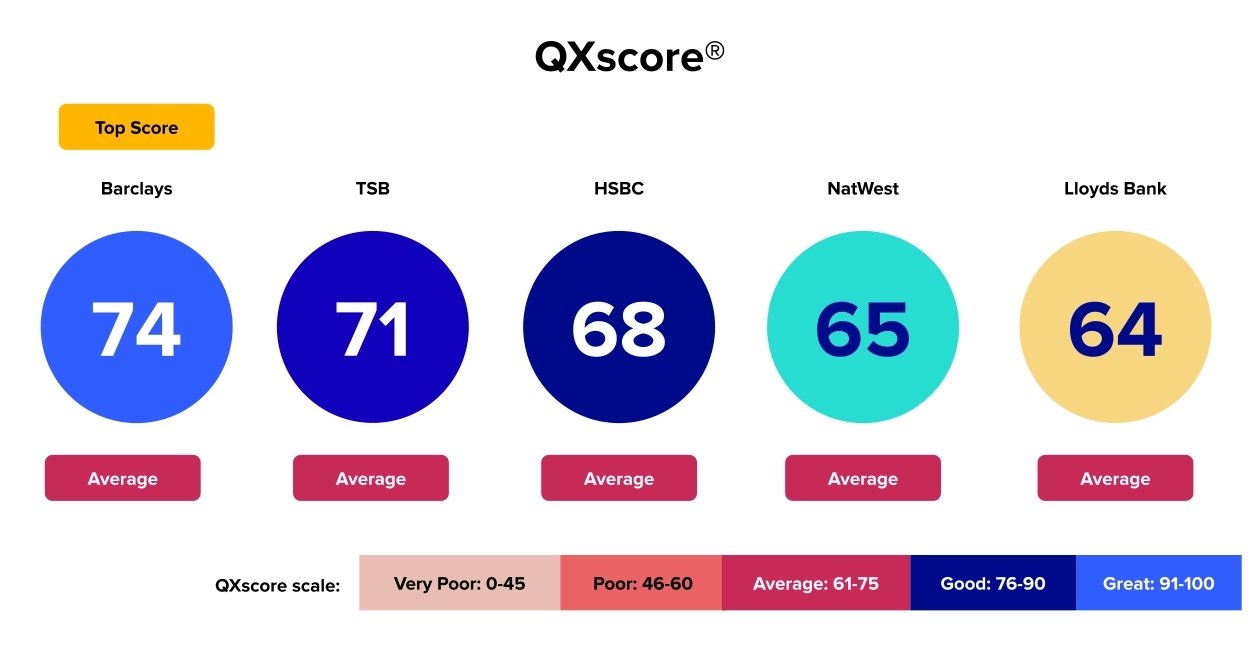

Barclays are the top performer but all banks have an overall ‘Average’ Quality Experience score.

Explanation: This ‘QXscore’ is based on customer behaviour (successfully completing key tasks on the website) and customer attitudes towards the website. Users were asked to complete 3 tasks:

- Find a Rewards/Cashback Credit Card

- Find out how much you can borrow using the mortgage calculator

- Find out where to apply for an Overdraft

Sample: 250 participants from the UserTesting panel May 2024

Success Factors

What are the overall factors impacting success?

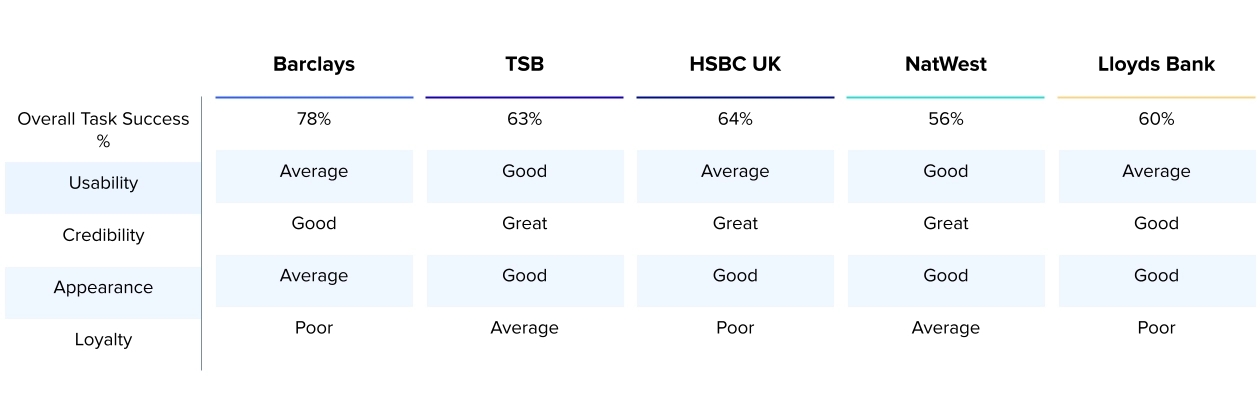

Improving navigation and find ability is critical across all sites even in the top performers.

Streamlined and intuitive website navigation is essential for quickly capturing the engagement of new customers.

Not only do low success rates indicate poor usability, but users also provide feedback to support this.

User Feedback

What did our users have to say about their experience?

Direct quotes from users who took part in the study tell us specifically what was difficult or frustrating about their experience.

Task Completion

How difficult is it to find a credit card?

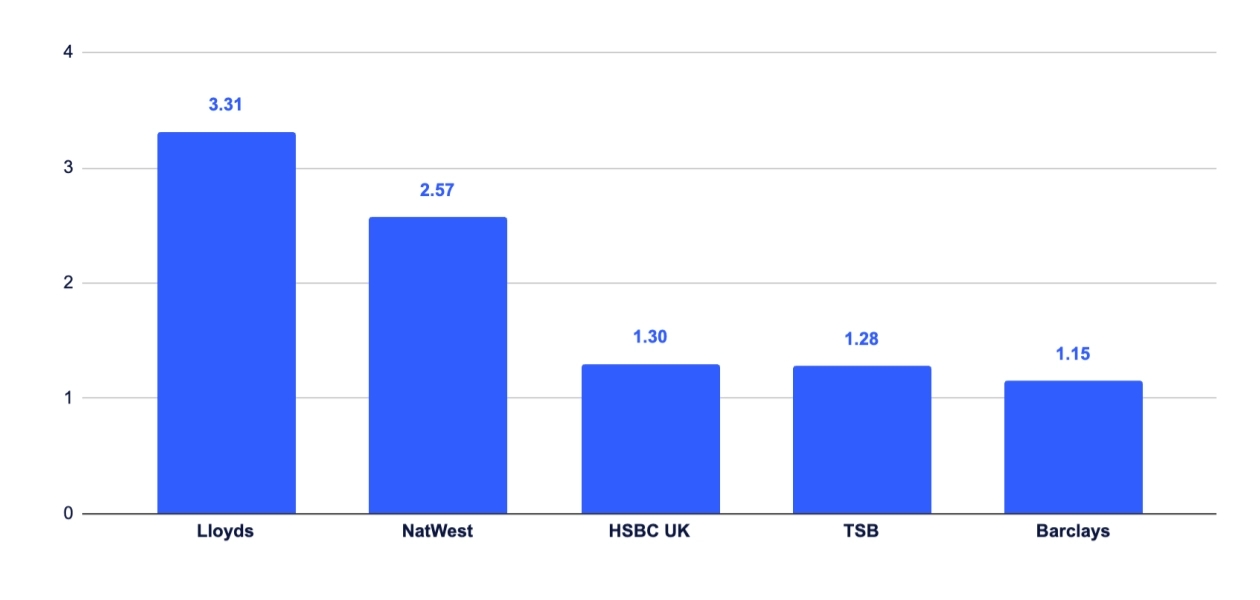

Average time to complete the task (mins): Find a credit card which offers Rewards/Cashback

Banks with longer customer journeys often receive lower overall experience scores and face the risk of decreased conversion rates. As we can see from this data, some users took over 3 minutes to find the credit card they were looking! Obstacles that are driving up the number of clicks and time taken to complete a task are standing in the way of important results — a returning visit and conversion.

How do you stack up?

Stand out in an increasingly crowded market by identifying areas and obstacles you can resolve and start differentiating your digital experience.

Request a personalised comparison to see how UserTesting can help you gain a winning edge. Fill out the form and we will be in touch shortly!