In this report

Report: Tariffs and trade-offs: what rising prices mean for brand trust and consumer loyalty

Report: Tariffs and trade-offs: what rising prices mean for brand trust and consumer loyalty

Rising prices are no longer a temporary challenge, they’re fundamentally reshaping how consumers make decisions, engage with brands, and define value. For businesses, this shift presents both risk and opportunity: in a climate of economic pressure, brand loyalty is more fragile, and customer expectations are evolving fast.

To understand how global tariffs are influencing real-world behavior, UserTesting partnered with Talker Research to survey 4,000 consumers across three key markets: the United States, the United Kingdom, and Australia. The findings reveal how price sensitivity, trust, and transparency now drive decision-making, and what brands must do to stay relevant in the face of rising costs.

Survey breakdown:

- United States: 2,000 respondents

- United Kingdom: 1,000 respondents

- Australia: 1,000 respondents

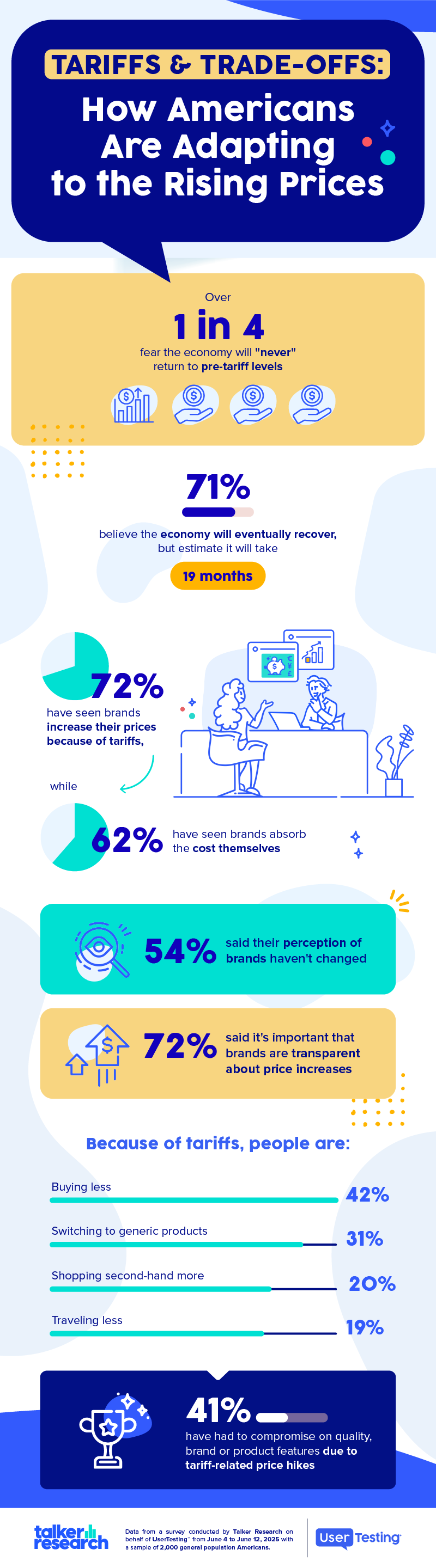

United States: nostalgia is fueling a new wave of brand loyalty

Americans brace for a long-term shift

Tariffs have introduced a level of economic uncertainty that many Americans now see as permanent. Nearly one-third of U.S. adults believe the economy will never return to its pre-tariff state. Even the optimistic project an average timeline of 19 months for recovery, signaling prolonged economic strain ahead.

Emotionally drained, financially strategic

The emotional toll of tariffs is driving real behavioral change. When Americans hear about tariffs, they report feeling stressed, overwhelmed, and frustrated. These emotions translate into action: buying less, opting for generics, shopping second-hand, and scaling back travel. It’s a widespread financial recalibration, not just isolated frugality.

Transparency = trust

While 72% of consumers have seen companies raise prices due to tariffs, over half say their perception of those brands remains unchanged. Why? Because what matters most is honesty: 72% say transparency about pricing changes is critical to maintaining trust. Still, 50% of consumers reported switching to lower-cost alternatives, proving that even trusted brands must continue earning loyalty.

Trade-offs are the new normal

41% of Americans say they’ve compromised on quality, brand preference, or features due to tariff-related increases. From groceries to vacations, financial fatigue is leading to long-term shifts in how people prioritize purchases.

ON-DEMAND WEBINAR

Winning repeat customers: How retailers can optimize every digital touchpoint for more conversions

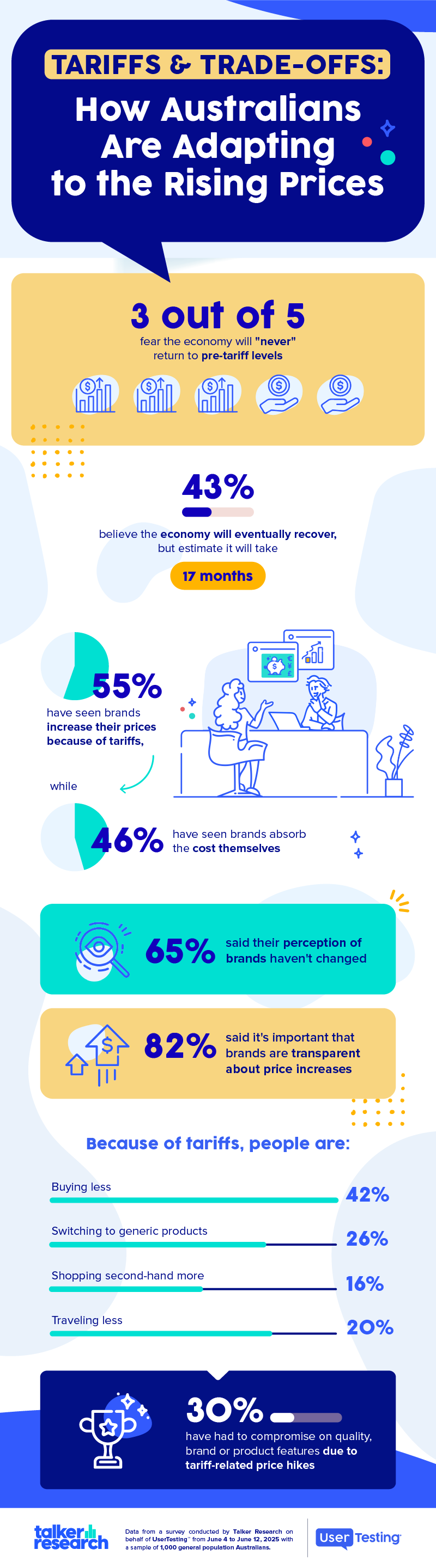

Australia: A Shift Toward Local and Leaner Living

Awareness lags, but the impact is clear

Only one-third of Australians say they fully understand how tariffs affect their lives, but they’re still feeling the effects. Stress and frustration are common, and 60% of Australians fear the economy may never fully recover. Even those who expect a rebound estimate a 17-month timeline.

Cutting costs becomes the norm

Rising prices have pushed Australians into a leaner mode of living. Shoppers are switching to lower-cost brands, buying less overall, shopping second-hand, and cutting travel. These changes signal a broader cultural shift—one that values resilience and resourcefulness in the face of global instability.

Brand perception hinges on clarity

55% of Australians have noticed brands raising prices, while nearly half say they’ve seen some brands absorb costs. Despite price hikes, 65% say their perception of these brands hasn't changed—as long as communication remains clear. A remarkable 82% of Australians say it's important that companies are transparent about why prices are rising.

A surge in domestic preference

Nearly two-thirds of Australians now say they prefer to buy Australian-made products because of tariffs, and many are willing to pay significantly more—an average of AUD $74—to do so. Supporting local is increasingly seen as both practical and patriotic.

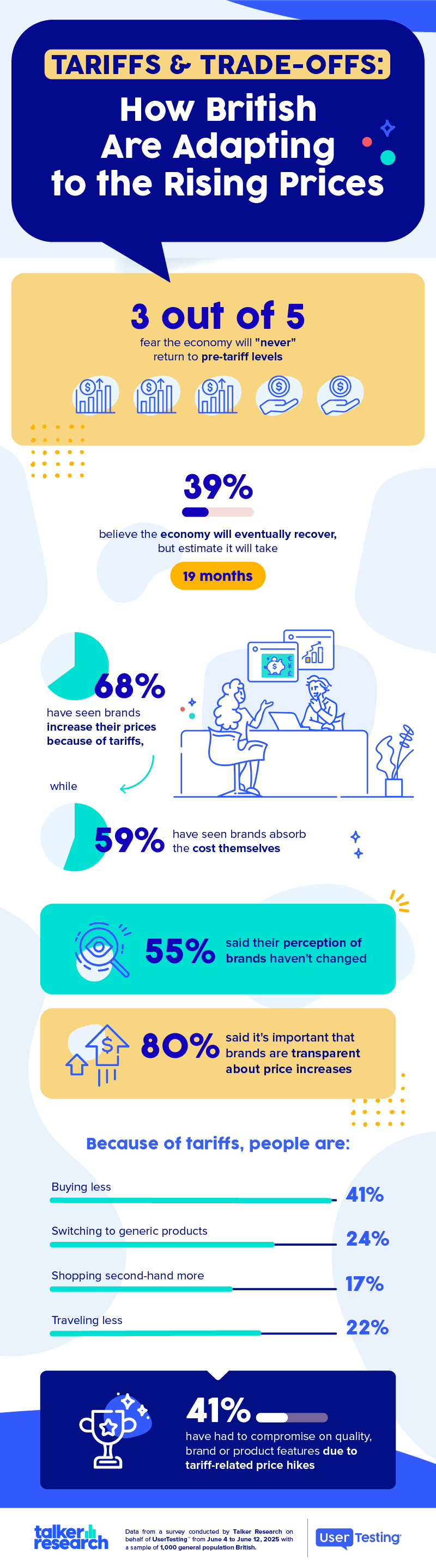

United Kingdom: local loyalty rises amid economic strain

Cautious, pessimistic, and price-sensitive

Three in five British consumers believe the U.K. may never fully recover from tariff-related economic challenges. Those who do believe in a rebound estimate a recovery timeline of 19 months. With that outlook, many are already shifting their behavior, not just to cope, but to adapt long-term.

Brands face a changing value equation

U.K. consumers are increasingly budget-conscious: buying less, choosing generics, shopping second-hand, and even working more to offset rising costs. These changes point to a deep reassessment of what they consider “worth it” when it comes to purchases.

Communication is a loyalty lever

Even as 68% of consumers notice brands raising prices, most aren’t assigning blame–if those brands explain why. Eight in ten respondents said transparency is vital when prices change. It’s a clear message: uncertainty is tolerable when communication is clear.

A return to local

Tariffs are driving a resurgence in local brand loyalty. Over half of U.K. consumers now prefer domestically made products and would pay, on average, £112 more for them. That’s not just about nationalism, it reflects trust in local supply chains and a growing preference for homegrown reliability.

Conclusion: what brands should do now

Consumers across all three countries share a consistent outlook: rising prices are likely here to stay. But what differentiates brands at this moment is how they respond. People aren’t just reacting emotionally, they’re adjusting their habits, reevaluating loyalty, and rethinking what they value most.

The takeaway for companies is clear: this is a moment to lead with empathy, transparency, and practical value.

How brands should respond

Be transparent across digital touchpoints. Whether it’s pricing pages, product FAQs, or lifecycle emails, clearly explain why prices are changing. Don’t assume customers will connect the dots, you must spell it out.

Elevate value in product copy. Reframe messaging to emphasize benefits that matter during economic stress: durability, convenience, long-term savings. In uncertain times, customers care more about outcomes than features.

Speak to financial empathy, not just benefits. Acknowledge the reality of trade-offs. Customers appreciate brands that “get it.” Test messaging that reflects understanding, without sounding apologetic or vague.

Survey methodology

Talker Research surveyed 2,000 general population adults in the United States, 1,000 in the United Kingdom, and 1,000 in Australia. The survey was commissioned by UserTesting and conducted online between June 4 and June 12, 2025.

GUIDE