Here are America’s favorite Halloween candy and costumes in 2025

Every October, store shelves fill with sugar, sequins, and storytelling. Halloween is more than costumes and candy, it’s a moment when people reveal how they make choices: nostalgic vs. new, impulsive vs. planned, classic vs. creative.

To find out what those choices say about consumer behavior, the UserTesting team surveyed 300 people across genders and regions in the U.S.

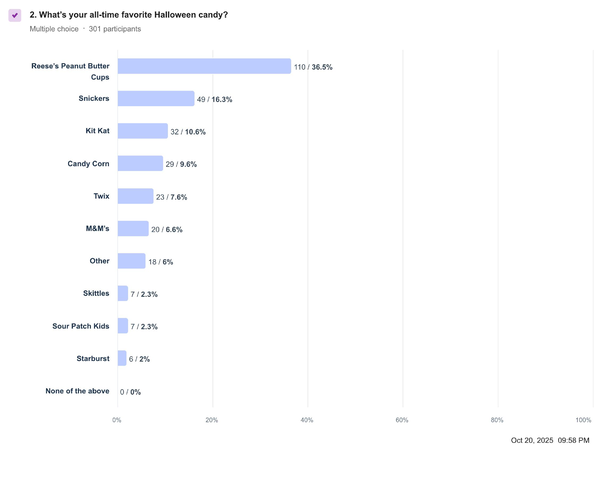

Reese’s: The uncontested candy king

When asked to name their all-time favorite Halloween candy, Reese’s Peanut Butter Cups demolished the competition with 36.5% of total votes.

- Snickers trailed at 16%

- Kit Kat at 11%

- And the ever divisive candy corn clung to life at 9%.

By gender:

- Men (33%) and women (38%) stood in rare agreement: Reese’s rules.

By region:

- Midwest: 55% (absolute peanut butter dominance)

- South: 41% (a close second)

- West Coast: 31% (slightly more varied tastes)

- East Coast: 29% (with Kit Kat sneaking into second place)

Insight: comfort is the new crave.

Reese’s wins not because it’s new, but because it’s familiar. In a crowded market, emotional reliability beats novelty. It’s proof that brands that deliver consistent delight become part of people’s rituals.

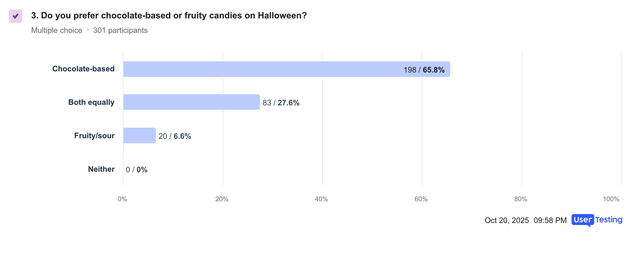

Chocolate still reigns supreme over fruity flavors

When it comes to Halloween flavor preferences, the verdict was clear:

- 66% prefer chocolate-based candies

- 28% love both chocolate and fruity sweets equally

- and only 7% went all-in on fruity or sour

Women (69%) were slightly more chocolate-loyal than men (61%), while the Midwest once again topped the leaderboard at 71%.

Insight: indulgence is rationalized as reward.

Chocolate satisfies more than a craving—it delivers emotional permission. Consumers justify small indulgences when they feel earned, a lesson for brands designing “treat yourself” moments year-round.

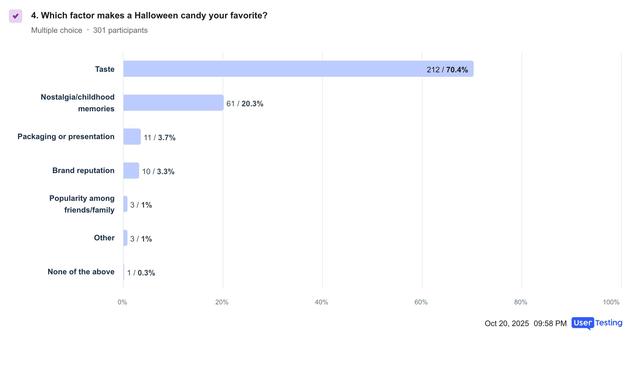

Taste, not trends, drive loyalty

When asked what makes a candy their favorite:

- 70% said taste

- 20% cited nostalgia or childhood memories

- Fewer than 5% mentioned brand reputation or packaging

The Midwest was almost purely taste-driven (86%), while the East Coast showed the most sentimental streak (23% nostalgia).

Insight: experience wins where branding stops.

Flavor memory is a form of brand equity, one you can’t buy with packaging or positioning alone. In other words, the user experience is the product.

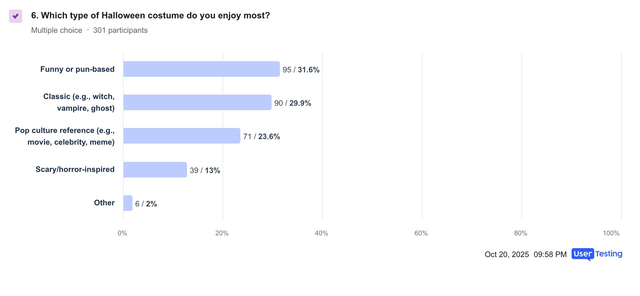

Costumes reveal the psychology of play

Costumes are storytelling in fabric form. When we asked which type people enjoy most, the nation split into three clear tribes:

- Funny or pun-based: 32%

- Classic (witch, vampire, ghost): 30%

- Pop culture references: 24%

- Scary/horror-inspired: 13%

Men leaned toward pop culture and horror; women skewed classic or funny. The Midwest topped the charts for humor (39%), while the West Coast clung to timeless icons (38%).

Insight: humor equals optimism.

People use costumes to project emotion. When “funny” wins, it suggests cultural appetite for levity—and an opportunity for brands to align with that energy through playfulness and self-expression.

GUIDE

Actionable insights at every stage of development

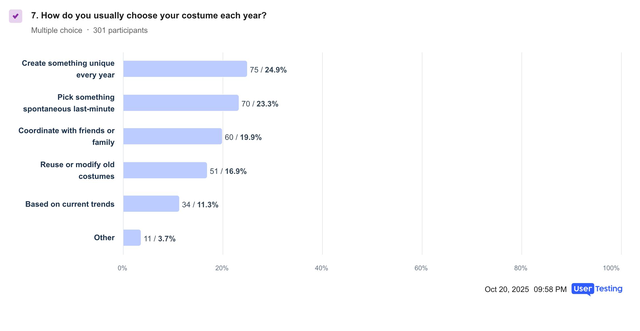

Creative intentions, last-minute execution

Only 25% of respondents said they create something unique every year, while 23% admit they throw something together at the last minute.

- Women (27%) were slightly more likely to DIY

- Southerners (29%) were the most creatively inclined

- Midwesterners (24%) led in group coordination—because nothing says team spirit like matching ghosts

Insight: spontaneity is a CX opportunity.

Last-minute creativity doesn’t signal apathy—it signals openness. Brands that simplify decision-making for procrastinators (quick kits, flexible shipping, curated “panic-buy” guides) can turn chaos into conversion.

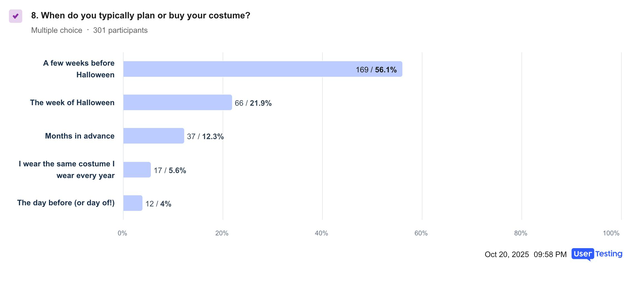

Planning vs. panic buying

When do people plan or buy their costumes?

- 56% shop a few weeks before Halloween

- 22% wait until the week of

- 12% plan months ahead

- and 4% confess to buying the day before

The Midwest is the most prepared (67%), while the South leads the “week-of” rush (25%).

Insight: urgency is part of the fun.

Shoppers expect to feel the pressure. For marketers, that means designing experiences that make “last-minute” feel less like stress—and more like seasonal excitement.

Final treat: what Halloween teaches about everyday decisions

Halloween isn’t just a one-night event, it’s a national case study in how people decide.

It highlights how emotion, nostalgia, and timing influence behavior across industries.

- Taste > trends. People reward experiences that deliver, not promises that sound good.

- Nostalgia drives loyalty. Familiarity feels like comfort in uncertain times.

- Procrastination is predictable. The “I’ll figure it out later” audience is a marketer’s goldmine—if you meet them where they are.

In short: whether you’re selling candy, costumes, or customer experiences, success comes from understanding why people choose what they choose.

Because even on Halloween, the scariest thing isn’t ghosts, it’s ignoring what your customers are really telling you.

GUIDE