The 2026 marketing priorities report: key investments, practices, and concerns from 381 marketing leaders

Marketing is changing faster than most teams can keep up, and 2026 is shaping up to be the year everything gets rewritten. AI adoption is accelerating, search is evolving and (yet) audiences are demanding more authenticity than ever. So we decided to ask decision-making marketing leaders: what’s actually happening?

We surveyed 381 marketing leaders to uncover what they’re prioritizing, where they’re investing, and what they’re worried about when it comes to AI.

For a more in-depth analysis, we also segmented the results by:

- Region (US, Europe)

- Company size (small, mid-market and enterprise companies)

- Verticals (retail, B2B SaaS and financial services)

While there are noticeable differences across segments, marketers are continuing to invest heavily in AI, even if the ROI isn’t fully proven yet. At the same time, they’re showing a healthy regard for authenticity and are cautious about becoming overly dependent on new tech.

Key Findings:

- We surveyed 381 marketing leaders to uncover what they’re prioritizing in 2026

- AI adoption is mainstream, but most can't quantify its positive impact

- We're seeing a return to long-term brand building, and regrets over short-term tactics

- We're also seeing buyers remorse in AI tools, with greater scrutiny expected

- AI adoption and perception varies across industries,(B2B SaaS is both the most mature, and the most jaded when it comes to AI use)

- Very few are actually doing anything about GEO, despite the noise

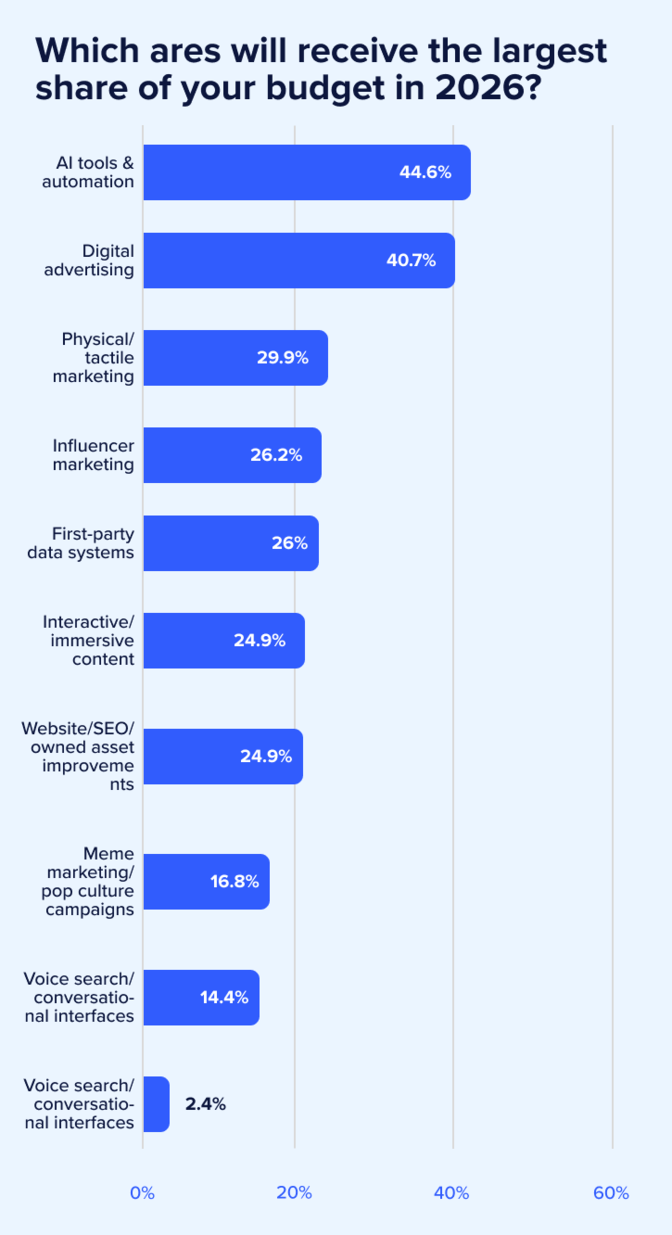

AI tools and digital advertising dominate 2026 spend priorities

AI tools and automation were the top investment for 2026 (45%), followed by digital advertising at 41%. Despite reports of declining ad performance across digital channels, spending shows no signs of slowing down, and it’s clear that marketers are spending on AI to ultimately produce ads faster, cheaper and better targeted.

Interestingly, website and SEO optimization is trending toward the bottom of the list at 25%, indicating that marketers aren’t focusing on AI-based search as much as you would expect. Instead, the focus is still very much on outbound marketing and how AI can supercharge it.

- US companies lean especially hard into AI (47%) and digital advertising (46%) and are more likely to prioritize first-party data systems, which is third on the list of 2026 budgets compared to the EU where its sixth

- Larger companies place more emphasis on first-party data systems, which makes sense as enterprise tech stacks are more complex with more integrations required for effective data centralization and analysis.

- Retail/eCommerce over-index on digital ads (45%) plus first-party data, while B2B SaaS put a very strong emphasis on AI tools (66%)

AI adoption is already mainstream; almost 9 in 10 marketing leaders invested in 2025

Almost 85% invested in AI in some form in 2025, with nearly half reporting significant investment. However, not everyone is going all in just yet.

- Large revenue companies have the highest share of “significant” AI investment

- Under $50M revenue companies are more likely to be in the “limited” or “no investment” categories

- B2B SaaS and financial services both show very high adoption of AI, with B2B SaaS particularly skewed toward significant investments

Not everyone’s seeing an ROI on AI investments (yet)

While most marketers (63%) say AI met or exceeded expectations, almost a quarter are either disappointed or cannot measure ROI yet.

- US marketers are slightly more likely to say investments fell short or have no measurable ROI

- Larger companies are more likely to report their AI investments have exceeded expectations

- Retail/eCommerce and B2B SaaS have stronger “met/exceeded” shares than financial services, which skews more toward “too early to tell” or hard to measure

Looking at the data, it’s plausible that the marketers most likely to be disappointed with AI are early adopters (US-based companies, tech companies) because they’re past the point of being enamoured with the technology and now realizing that it’s not going to magically solve their problems. Late adopters, such as EU-based companies and banking companies, are either still in the honeymoon phase or moving cautiously before committing.

ON-DEMAND WEBINAR

Effective AI: how to choose the right generative AI features—and build them fast

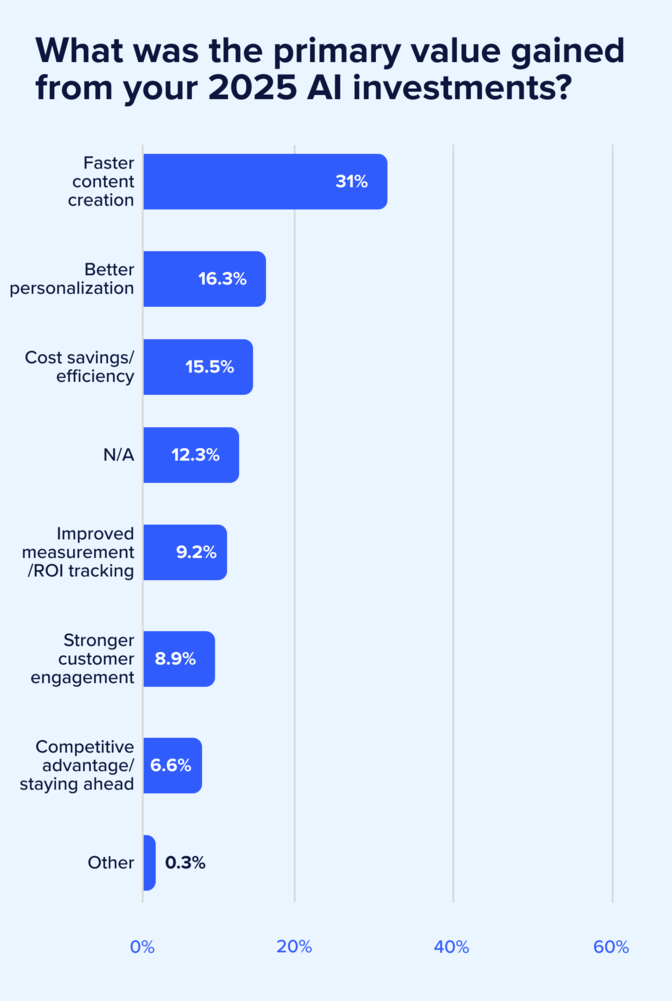

Speed and personalization are the main AI benefits realized so far

The top AI use case for marketers has been content creation. AI is also enabling marketers to better personalize content for different audiences.

These time-saving tactics are saving money, but haven’t yet translated to larger marketing benefits. Less than 10% of respondents believed AI was helping them achieve a competitive advantage or stronger customer engagement (mostly because everyone else is using AI, too).

- Smaller companies rely most heavily on faster content creation as the key benefit

- Mid-market and larger firms are more likely to cite cost savings and improvements in measurement and ROI

- Retail/eCommerce brands emphasize personalization and content speed, while B2B SaaS is more likely to highlight a competitive advantage by leveraging AI

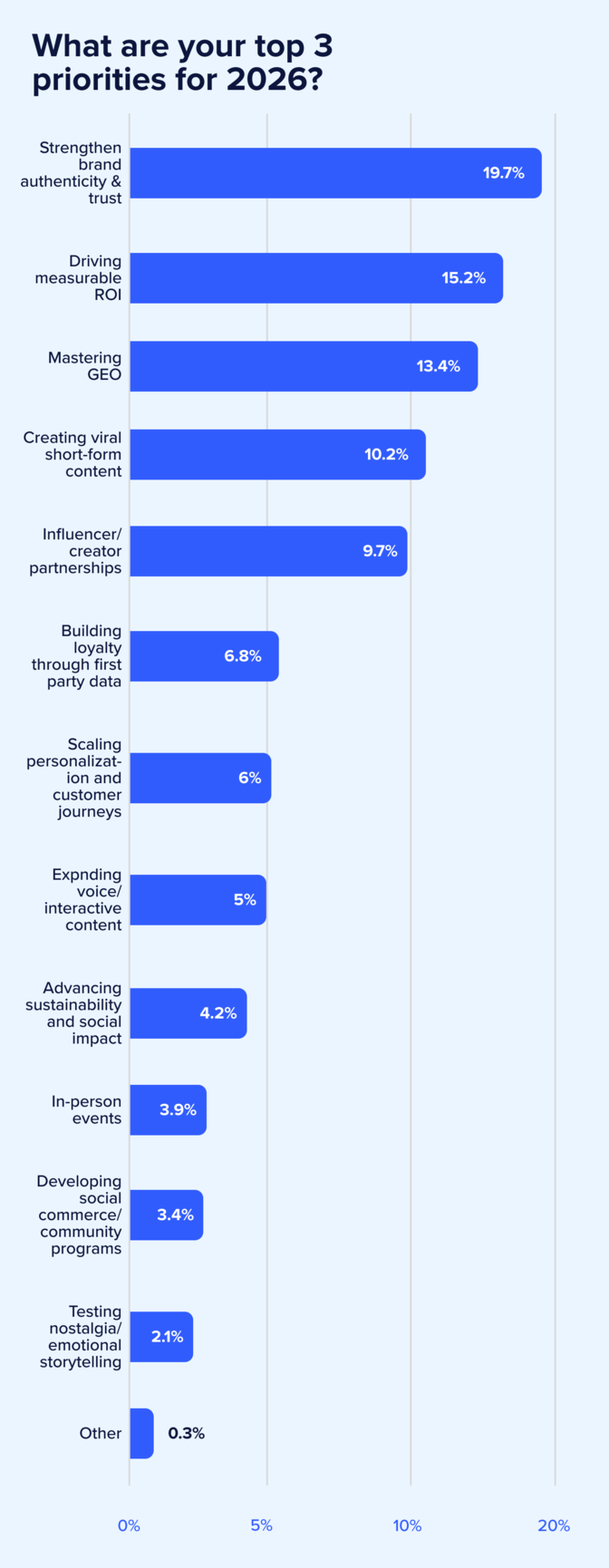

Building brand authenticity are marketers top priority

Brand building (20%) returns as the top marketing priority for 2026, closely followed by driving measurable ROI from AI adoption (15%). Marketers are focusing on core goals and will intensely scrutinize AI investments for return, especially in larger companies and early adopters like B2B SaaS.

- US marketers over-index on brand authenticity & trust (25%) compared to the EU, where returns on AI investment are the top priority (15%) and resources are more evenly spread across GEO, brand authenticity and short form video.

- Larger companies and B2B SaaS show relatively stronger emphasis on GEO as a strategic capability.

- Retail/eCommerce tilts toward AI ROI and personalization.

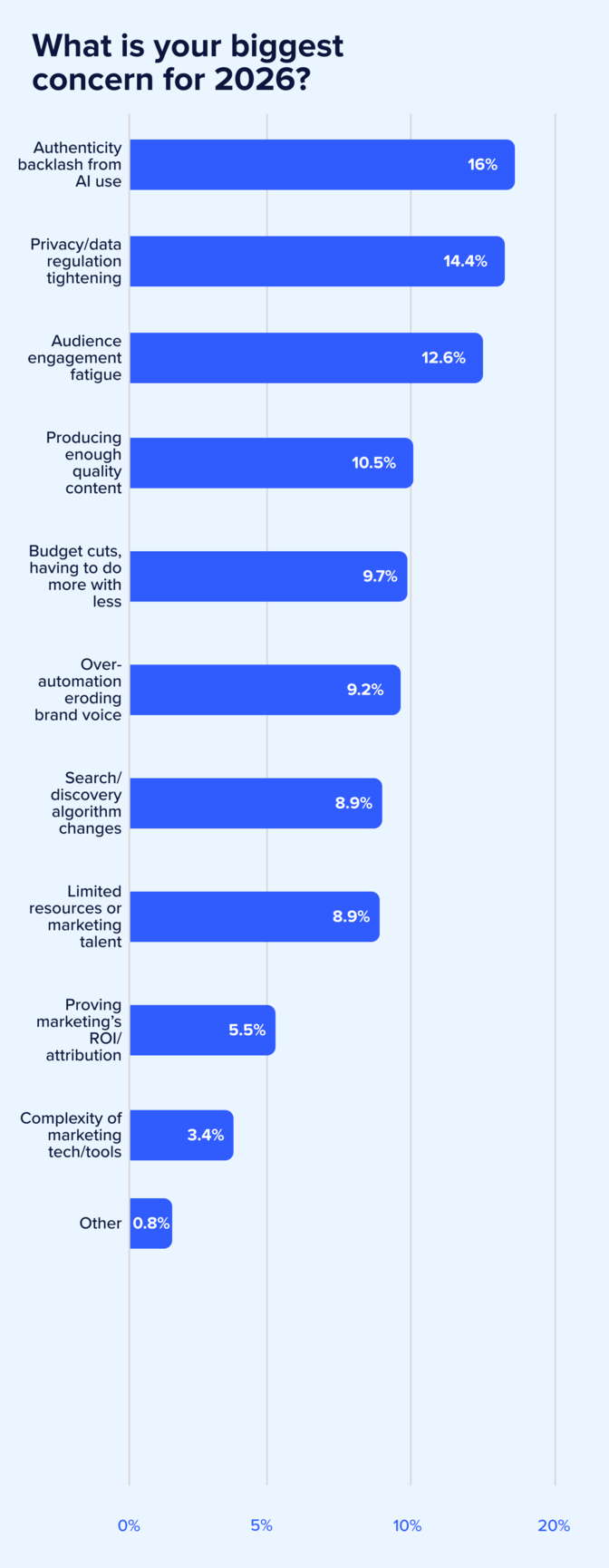

Authenticity backlash and privacy/regulation are the top worries

Mirroring the top priorities, losing credibility and authenticity over extended use of AI (16%) is a marketing leader’s top concern, followed by increased regulation around how they can use data (14%). Audience engagement fatigue is another worry (13%).

All of this highlights that overall, while recognizing AI’s immense power, marketers are very much aware of its diminishing returns. They know the dangers of mass-produced AI-content, creating more audience fatigue and eroding trust. In the next year, marketers will show more restraint and place a premium on human creativity and authenticity.

- EU marketing leaders are particularly more worried about privacy and regulation given the stricter consumer privacy laws in that region.

- Smaller companies are more concerned about keeping pace and engagement fatigue; a real issue when they’re often taking on incumbents with larger resources and the same AI tools as them.

- Financial services strongly emphasize regulatory risk and authenticity, no surprise given the industry's heavy regulation.

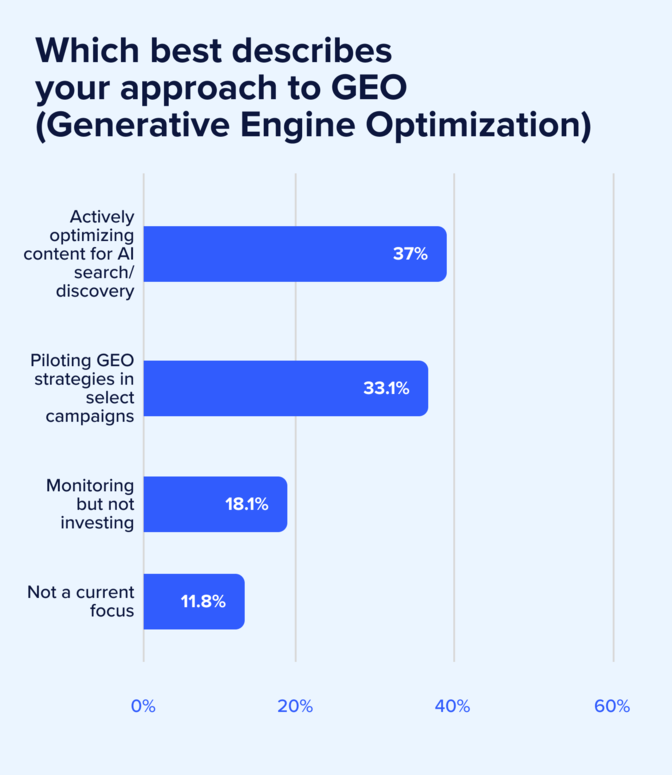

Everyone’s thinking about GEO, but few are taking action on it

Conversations about GEO (optimizing your content to be discovered by gen-AI engines) are near ubiquitous at this point, but when it comes to actions, most companies are still in the planning (24%) and experimentation phase (25%). Only 22% are actively optimizing content for AI search, while almost 30% are taking no action.

That’s because it’s not immediately clear if GEO strategies are that much different from SEO strategies. That could all change when ChatGPT introduces ways for customers to shop directly through its platform, in which case retailers will have to move fast to adapt.

One retailer embedding AI shopping in their customer journey is Target, which recently announced its curated, conversational shopping experience inside ChatGPT. The experience allows shoppers to browse, get personalized recommendations, and complete multi-item purchases within its new Target app in ChatGPT.

"At Target, everything starts with the guest, and that means meeting them wherever they are, including emerging spaces like ChatGPT, where millions of consumers visit," said Prat Vemana, executive vice president and chief information and product officer at Target in a press release.

- Larger revenue companies are most likely to be actively optimizing.

- Under $50M companies cluster in planning or monitoring stages.

- B2B SaaS has above-average rates of active GEO optimization, which makes sense given that ChatGPT is now one of the first places software buyers look when they’re shortlisting vendors.

Most teams plan to implement guardrails for AI content.

If this past year saw the proliferation of AI-generated content, we can expect greater oversight of AI in 2026. The vast majority (73%) of marketers are at least somewhat likely to establish process checks around AI-generated content. This includes monitoring content for plagiarism, hallucinations, made-up sources and copyright infringement.

- Larger organizations have the highest share of “very likely” (31%), reflecting more formal governance, (as well as more robust legal departments).

- Financial services (33%) are especially likely to formalize verification for compliance and risk reasons, compared to tech companies (25%) and retailers (18%), where oversight was less likely.

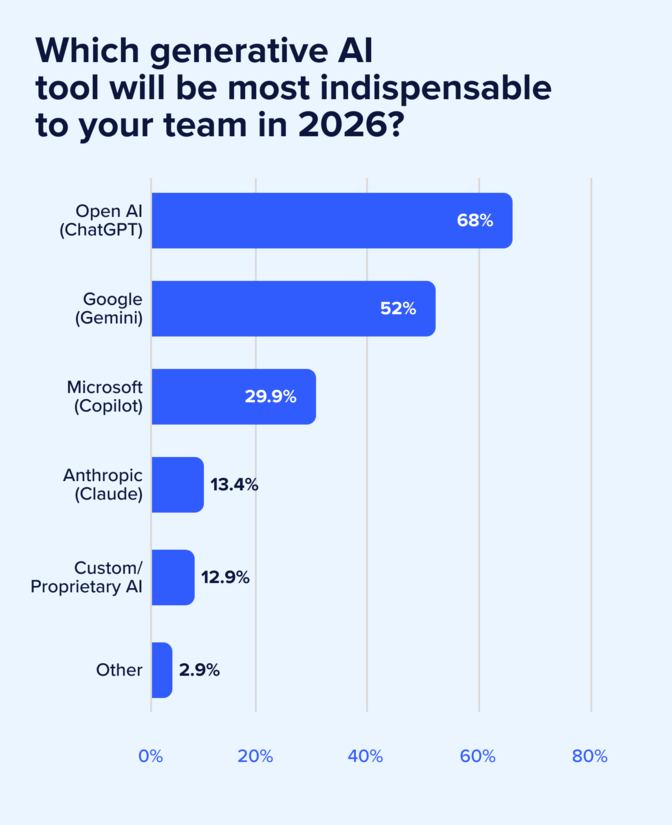

ChatGPT dominates as the go-to AI tool for 2026

Marketers overwhelmingly chose OpenAI’s ChatGPT as their most indispensable AI tool for 2026 (69%), followed by Google Gemini (52%) and Microsoft Copilot (30%). Tools like Anthropic Claude (13%) and custom AI solutions (12%) remain far less widely used.

For marketers, this rapid consolidation around a few major platforms means AI workflows are becoming standardized. Instead of experimenting with dozens of tools, teams are anchoring their processes on the biggest, most reliable engines. The opportunity now is less about adopting AI, and more about integrating it deeply into how teams create, collaborate, and scale their work.

- Enterprise companies had the highest percentage of Microsoft Copilot usage, highlighting how deeply Microsoft tools are embedded at the enterprise level.

- B2B SaaS companies, reflecting their early adoption, had the largest percentage of ChatGPT usage (80%), making it a core tool in every martech stack.

Prioritizing short-term wins over brand building is a top regret

Continuing with the theme of brand coming back in 2026, the top regret (38%) for marketers this year was over-indexing on short-term tactics over long-term brand building. This reflects the growing frustration with leaders expecting quick conversions and high engagement rates, which have gotten increasingly difficult.

There’s also a lot of buyer’s remorse for buying tools that didn’t deliver expected value (26%), which is another signal that marketers will be more discerning when it comes to buying tech next year, especially if it has “AI-powered” slapped on the label.

- Enterprise companies (33%) are more likely to regret over-spending on short-term tactics, mostly because small decisions add up to very large costs at their scale. They also have more teams and campaigns, which makes it easier for money to get spread around without driving real long-term impact. And with more data and oversight, they quickly see when quick wins don’t actually help the business grow.

- B2B SaaS companies are more likely (25%) to regret chasing trends that didn’t last, possibly reflecting the over-abundance of (mostly bad) marketing recommendations in the tech world.

- Smaller companies were the only group that mostly had no regrets (24%). And they shouldn’t! We all make mistakes in early stages, that’s how you learn.

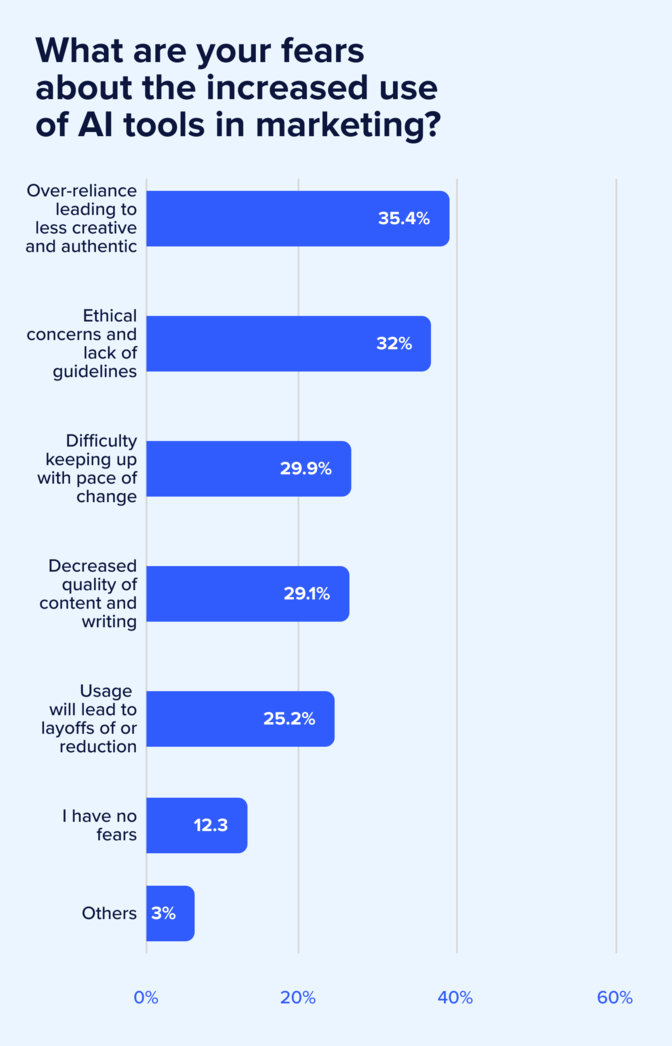

Over-reliance on AI and ethical concerns are top fears

Marketers’ biggest worry is over-reliance on automation hurting creativity and authenticity (35%), followed by ethical concerns (32%) and drops in content quality (29%) or the ability to keep up with rapid AI change (30%).

These fears point to a deeper insight: marketers aren’t afraid of AI taking their jobs, they’re afraid of AI making every brand sound the same. The risk in 2026 is about losing distinction. The teams that win will use AI to scale their output without sacrificing the human quirks, perspectives, and imperfections that make a brand memorable.

- Smaller companies emphasize keeping up with change and content quality.

- Larger and regulated verticals (especially financial services) heavily emphasize ethics and guidelines.

- Fear of workforce reductions is fairly consistent across segments.

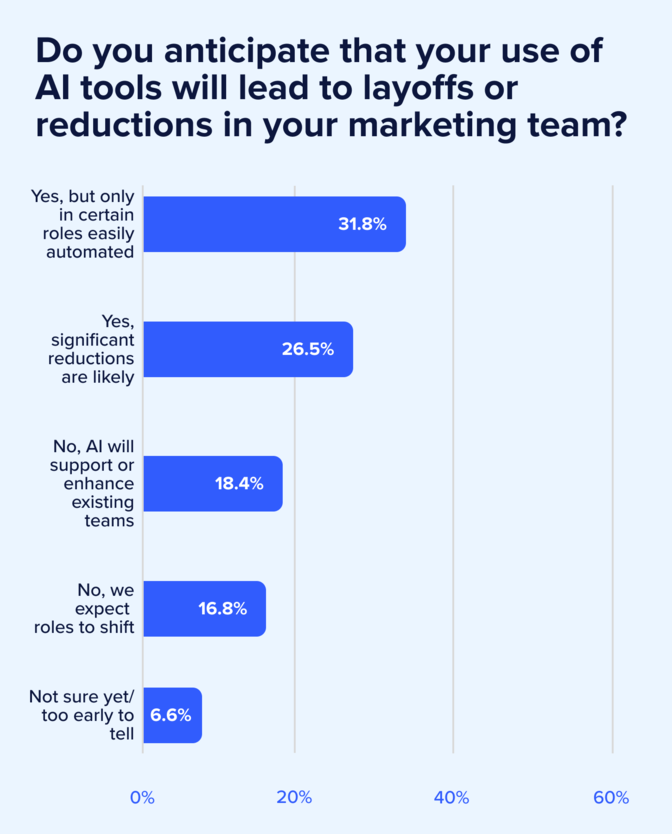

Everyone’s divided on whether AI will take their jobs

Nearly a third of marketers believe AI will cut roles that are easy to automate (32%), and another 27% expect more significant reductions. At the same time, a meaningful percentage say AI will enhance their teams (18%) or simply shift roles rather than eliminate them (17%).

What stands out is that marketers see AI less as a job killer and more as a job shifter. The optimistic outlook is that instead of mass layoffs, it’ll be the quiet disappearance of repetitive tasks and the rise of roles that blend creative judgment with AI fluency.

- Smaller teams are more likely to say AI will enhance or shift roles rather than reduce headcount, which is understandable since these teams are already running lean.

- Mid-market and large companies are more likely to anticipate targeted reductions in certain roles.

Key Takeaways

Taken together, the results paint a picture of a marketing industry evolving quickly, but thoughtfully, into the age of AI. Budgets and adoption are rising fast, but so are expectations: marketers are no longer impressed by speed alone, and they’re becoming far more critical of the quality, authenticity, and strategic value of the AI-generated work flooding the market.

At the same time, we’re seeing a welcome return to long-term brand building and creativity, as teams recognize that differentiation (along with efficiency) is what will set them apart in an increasingly automated landscape.

In 2026, the marketers who win won’t simply use AI more, they’ll use it wisely, pairing automation with the human imagination and brand identity that AI can accelerate but never replace.

ON-DEMAND WEBINAR