How retailers can win this holiday season

Here’s what 1,500 Consumers just told us about how they’re shopping for the holidays

Shoppers are cautious but not hopeless. Inflation is shaping budgets, but more than half of consumers still feel somewhat confident heading into the holidays.

Inspiration comes from community, not ads. Friends, family, and social media are where shoppers turn for ideas, not traditional brand pushes.

Stores aren’t dead. Shoppers still want to touch, feel, and grab items fast, but only if the in-store experience is smooth, organized, and rewarding.

Online expectations are sky-high. Speed, simplicity, and exclusive deals win loyalty. Anything less feels like friction.

AI can help, but not replace. People crave empathy and fairness when something goes wrong. Shoppers want tech that supports humans, not replaces them.

Now let's break this down.

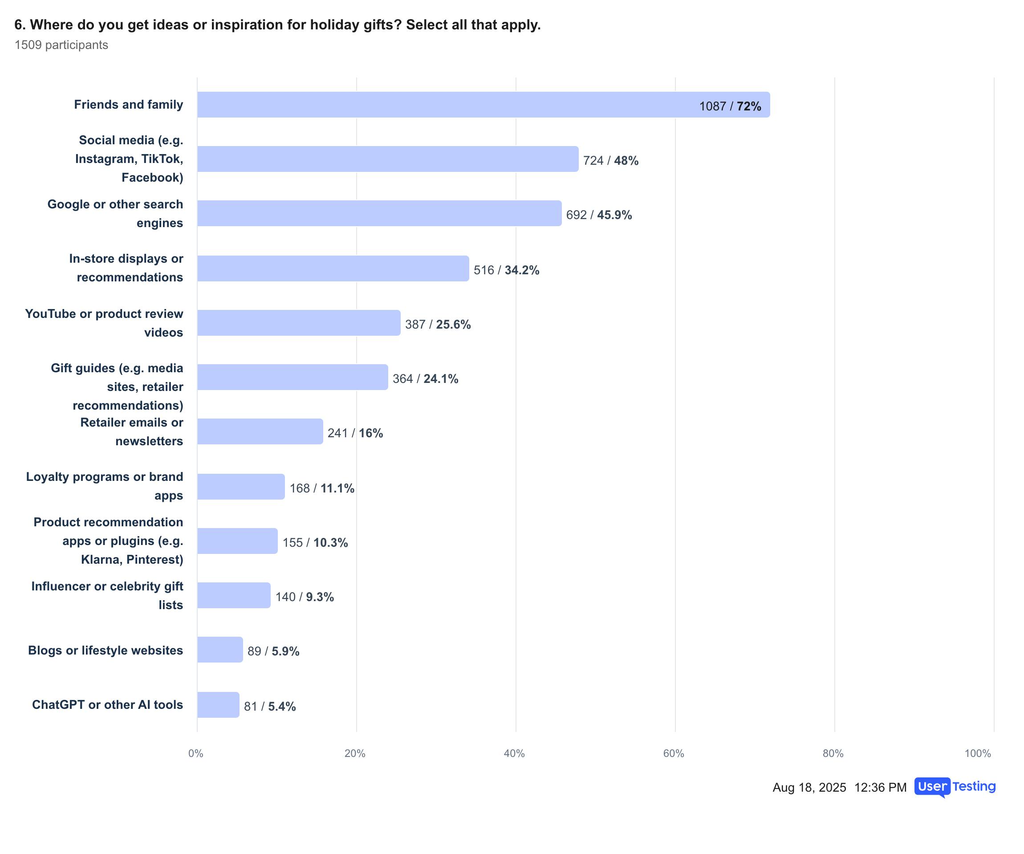

Buyers get their recommendations from trusted circles

Consumers don’t begin their holiday shopping with an ad. They start with conversations and recommendations from the people they trust.

72% say their main inspiration is friends and family. That’s not surprising, but what’s notable is how strong word-of-mouth remains in an era of digital noise.

48% turn to social platforms like Instagram and TikTok. For Gen Z, that number is nearly the same as personal recommendations, proving that digital influence has become peer-to-peer in its own right.

This tells us something important: traditional marketing channels are losing ground to trusted networks. Shoppers don’t want to be “sold to” first; they want to feel validated in their choices through others.

For retailers, this means leaning into community-driven marketing,highlighting user-generated content, engaging authentic creators (not just mega-influencers), and equipping loyal customers to share. The brands that “show up” in conversations, rather than just campaigns, will win a spot on holiday wish lists.

ON-DEMAND WEBINAR

Trust, tech & tariffs - a look how shopper behavior is evolving in 2025

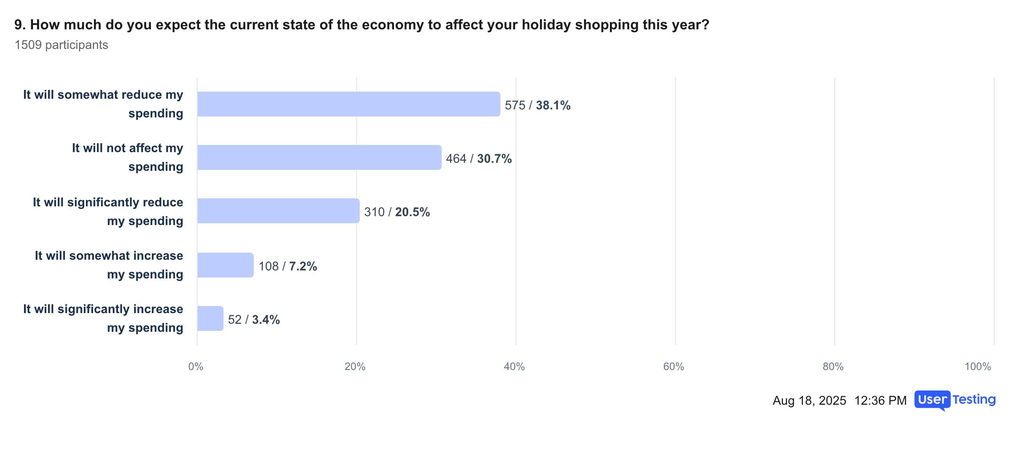

Economic uncertainty means cautious spending

Budgets are tighter, but spending isn’t disappearing.

- Over half (58.6%) say they’ll spend less because of the economy.

- Still, most plan to spend $101–$600 on gifts. That’s a middle ground, neither luxury splurging nor total restraint.

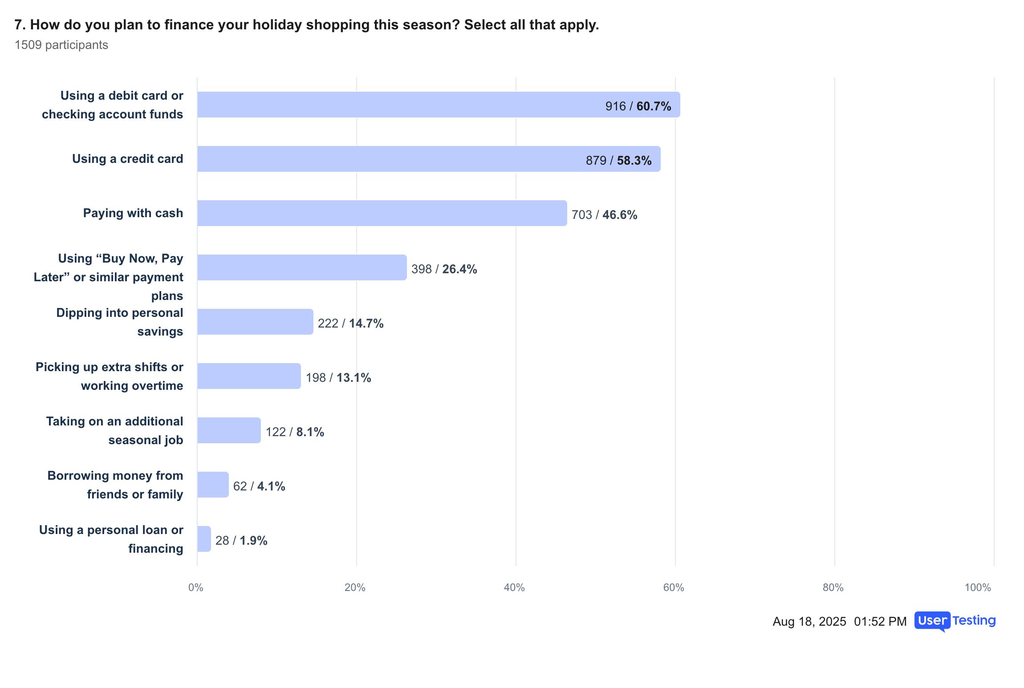

- 26.4% will use Buy Now, Pay Later (BNPL), and millennials are driving this trend at 36.6%.

What’s striking here is not just the dollar amount, but the psychology: consumers want to stretch their money without feeling deprived. BNPL isn’t just about affordability,it’s about keeping options open, smoothing cash flow, and maintaining a sense of control.

Retailers who ignore flexible payment options risk alienating a growing segment of shoppers. This is particularly true for millennials, who are both juggling debt and driving household purchasing decisions. Pair BNPL with transparent promotions and loyalty incentives, and you create the feeling of financial empowerment, something deeply valuable in a season where budgets are already under scrutiny.

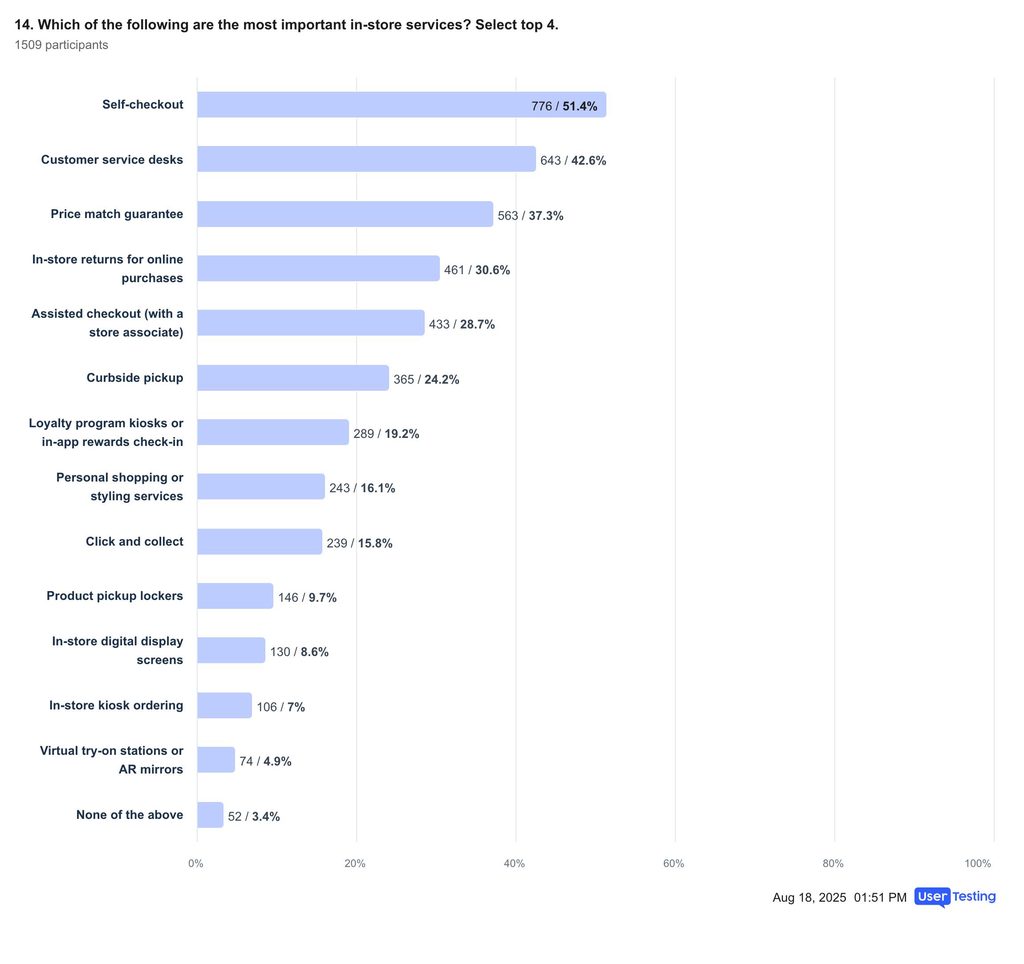

Shoppers still visit the store (if the perks are worthwhile)

Reports of brick-and-mortar’s death have been exaggerated. Consumers still crave the tactile, immediate nature of shopping in person.

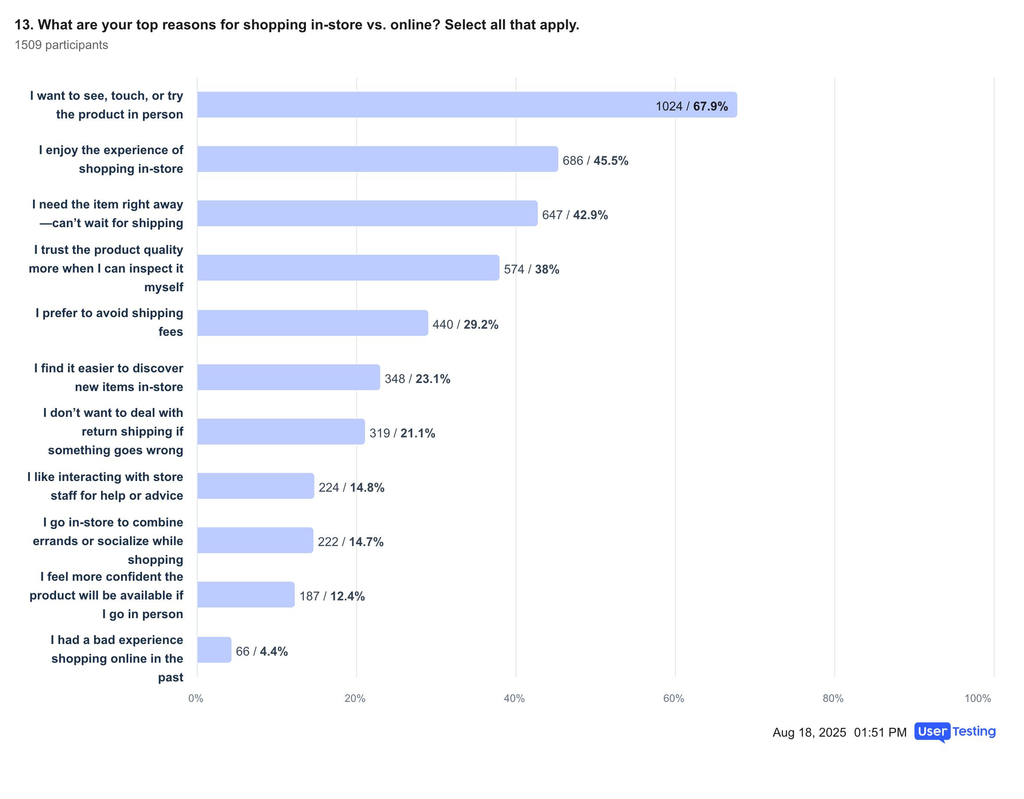

Why do they go?

- 67.9% want to see, touch, or try before they buy.

- 42.9% need something quickly.

- 45.5% actually enjoy the in-store experience.

But the in-store trip isn’t automatic, it has to feel worth it. When asked what makes them more likely to shop in person, consumers pointed to exclusive in-store discounts, loyalty rewards tied to visits, and clean, well-organized spaces.

That last one is telling: cleanliness and organization aren’t “nice-to-haves” anymore; they’re part of the trust equation. A messy store can undo goodwill just as fast as a bad return policy.

The takeaway: the best in-store shopping is a well-curated experience, not just a distribution channel. Retailers that use stores to surprise and delight,whether through exclusive drops, faster checkouts, or exceptional customer service,turn necessity into loyalty.

On-DEmand Webinar

Winning repeat customers: how retailers can optimize every digital touchpoint for more conversions

No room for error in the online experience

Expectations for a great online shopping experience have never been higher.

While most consumers say the experience has improved in the past six months, a third still think it could be better. That “could be better” is where opportunity lies.

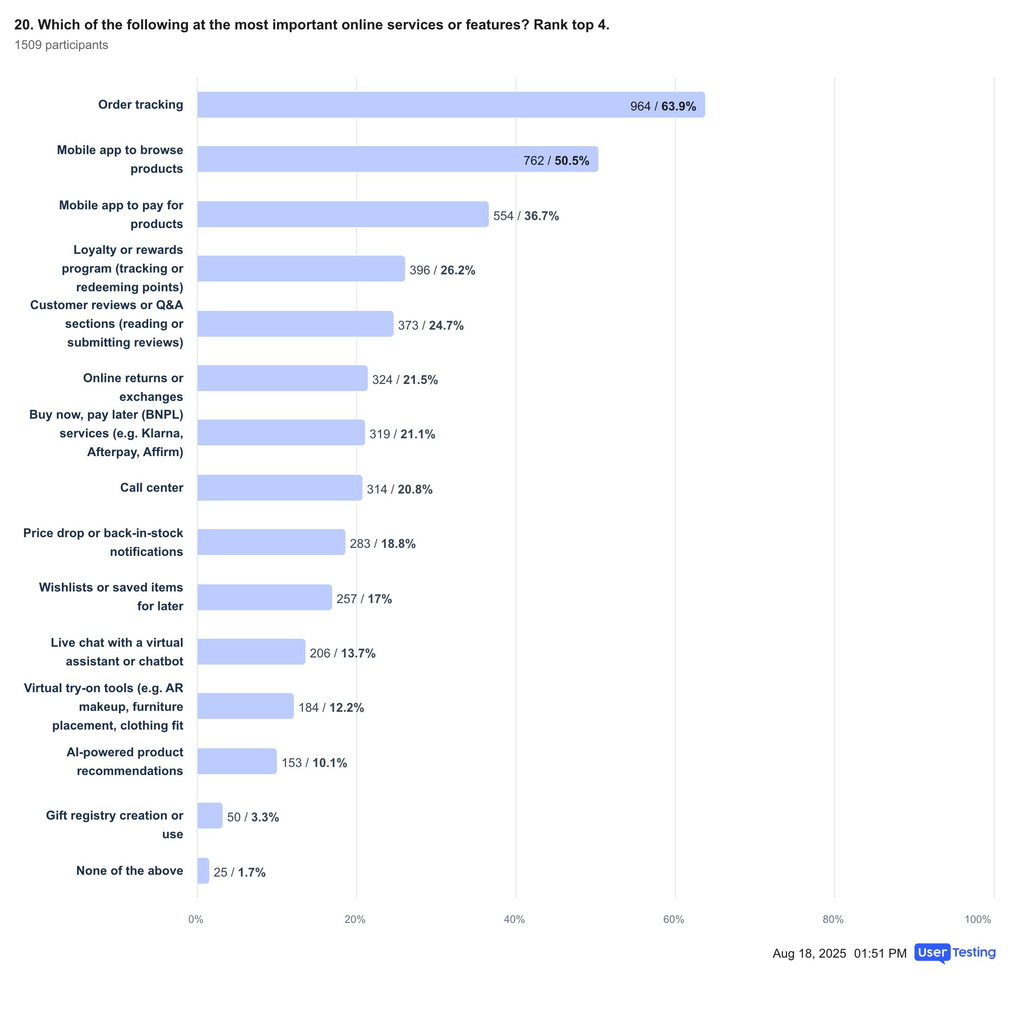

Today’s table stakes:

Order tracking (63.9%) is expected,not optional.

Mobile browsing apps (50.5%) keep shoppers connected.

Mobile payment (36.7%) is now a baseline expectation, not a perk.

What actually drives loyalty?

Exclusive online discounts (61.4%)

Loyalty rewards (53.4%)

Free/discounted shipping (46.5%)

But the real friction points come down to speed and simplicity. Nearly half of shoppers want real-time product availability and fast checkout. Add in smarter search tools, and you’ve got a recipe for retention.

Retailers should be asking: How many clicks does it take to buy something? How much info are we forcing customers to re-enter? Are we surfacing the right product at the right moment? Each barrier risks abandonment. In peak holiday season, those seconds translate into lost revenue.

Great service still matters (from humans, not bots)

The final piece of the puzzle is customer service. And here’s the headline: tech can’t replace empathy.

96% want a human involved when there’s a problem.

- 43.3% prefer to talk on the phone, 38.4% prefer live chat with a human.

- Only 4% prefer chatbots.

What earns goodwill?

Fast refunds (59.3%)

Quick resolutions (59%)

Feeling heard (45.6%)

What drives people away?

Slow responses (32.6%)

Lack of empathy (29.4%)

Delays in meaningful action (27.8%)

This doesn’t mean AI has no place,it means its role is different. Consumers are saying loud and clear: use AI to make human service better, not to replace it. Automate the background tasks, reduce resolution times, surface helpful data to agents. But keep the “front line” human.

The insight here? Shoppers will forgive a hiccup if it’s handled well. They won’t forgive being ignored or dehumanized, which is crucial to keep in mind when you design your next retail AI agent.

PODCAST

Holiday retail success: digital tips from Brian Walker

Key takeaways: The holiday playbook for retailers

So what’s the strategy for retailers facing budget-conscious shoppers with high expectations?

1. Lean into building authentic communities

Shoppers trust people, not ads, and the best brands know how to turn their customers into advocates. For the holidays, imagine a retailer spotlighting “12 Days of Real Gift Ideas” sourced entirely from customer posts, or encouraging shoppers to share unboxing moments for a chance to win.

This isn’t just marketing; it’s community-building. And in an age where 72% of shoppers look to friends and family for inspiration, it works.

2. Offer smart spending options

Consumers are cautious with their budgets, but they are still shopping. They want to feel they are making smart, manageable choices with their money.

Picture a fashion retailer promoting “Gift Now, Pay in February” options at checkout, paired with transparent budgeting tools that show exactly how much a shopper will owe and when.

These approaches speak directly to the 26% of consumers planning to use BNPL and the 58% who say they’re spending less this season. It’s not just about selling, it’s about empowering.

3. Elevate in-store incentives

Physical stores remain relevant because they offer immediacy, discovery, and human interaction. The challenge is making the trip enjoyable enough that shoppers choose it willingly.

Imagine a department store offering a “Holiday Fast Lane” checkout line for loyalty members, or exclusive in-store-only holiday bundles with immediate pickup.

When 64.9% of shoppers say exclusive in-store discounts would draw them in, it’s clear: In-store shopping becomes a competitive advantage when it feels organized, efficient, and worth the effort.

4. Design frictionless digital journeys

When shoppers go online, they expect the process to be seamless. Every unnecessary click, slow load, or confusing menu increases the chance of abandonment.

A mid-market retailer can exponentially increase customer engagement by combining guest checkout, digital wallets, and pre-filled repeat orders to reduce friction and increase conversion.

The principle is simple: design for speed and clarity, especially when customers are busy and distracted during the holidays.

5. Offer innovation (with a human touch)

Service remains the moment of truth for customer relationships. Shoppers appreciate technology that speeds up resolution, but they also want to know there is a person who understands their situation.

A retailer could use AI to instantly flag delayed shipping orders, while human reps proactively call customers and offer free express shipping or store credit.

Customers remember how they were treated in moments of stress, and empathy often matters more than speed alone.

With 96% of consumers saying they want a human in the loop, this isn’t optional,it’s essential.

See the key 2025 holiday shopping stats you need to know (infographic)

To bring these insights to life, we’ve visualized the most compelling data in an easy-to-digest infographic below. From spending habits and shopping preferences to what drives loyalty online and in-store, this snapshot offers a comprehensive overview of what consumers really want during the 2025 holiday season. Whether you're planning your retail strategy or simply curious about evolving shopper behavior, the infographic below highlights the key trends that matter most.

Inside the Human Insight Engine

See how top teams get fast, actionable insights in this 20 - 30 minute biweekly product tour, where each session highlights a unique real-world use case.