Financial services

Business services

NAB + UserTesting

From insights to impact: NAB’s journey to customer centric design

About the company

National Australia Bank (NAB) is one of Australia’s largest financial institutions, serving more than 10 million customers. In 2022, NAB acquired Citibank Australia’s multi-brand unsecured lending business. This added more than one million new customers and five white-label credit card brands, building on NAB’s existing offering to make it the largest credit card provider in the country.

Get started now

Contact Sales- 2days of design time saved every week

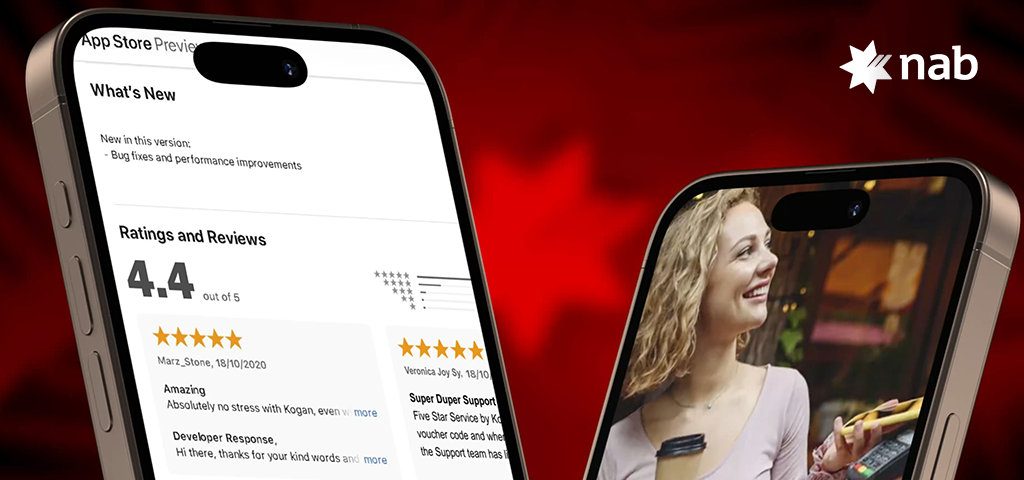

- 1.6 → 4.4iOS rating soars

- 90%of prototypes validated before launch

In 2022, NAB acquired Citibank Australia’s multi-brand unsecured lending business. The acquisition brought a unique challenge: NAB needed to migrate over one million customers across five different apps and brands, while maintaining trust and continuity for customers. Key priorities included:

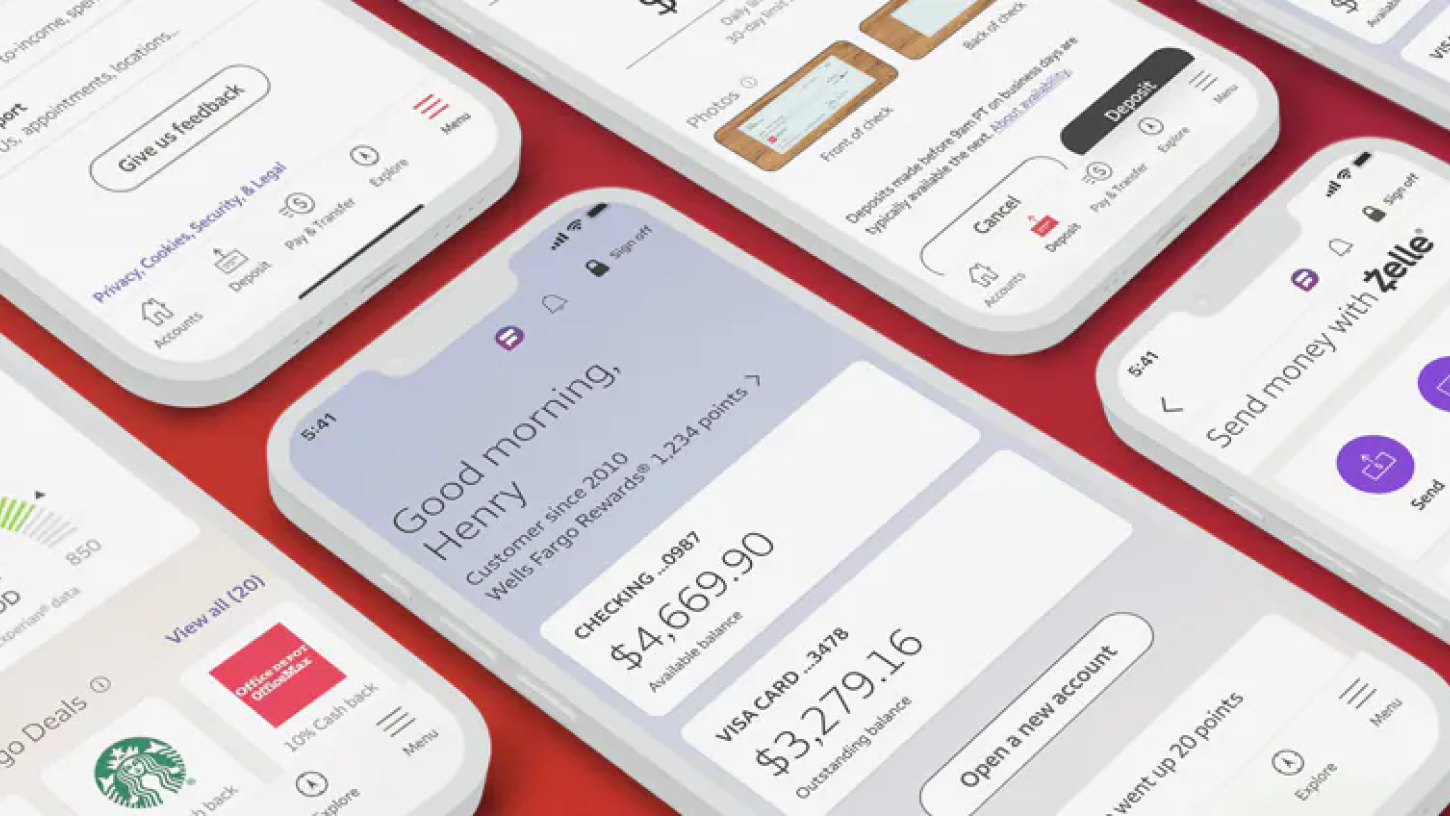

- Seamlessly moving customers to NAB-hosted channels without disrupting their existing credit card services or rewards programs

- Creating scalable yet differentiated digital experiences for each partner brand

- Reducing complexity while keeping the customer experience consistent across web, mobile, and assisted service

To aid the integration, NAB integrated UserTesting into its design workflows to ensure every digital experience was grounded in real customer insight. By making human feedback a consistent part of the product process, the bank shortened its “distance-to-customer” to just seven days and equipped more than 200 designers to evaluate their hypotheses and test ideas in prototypes. This turned customer insight into a strategic advantage. Rather than relying on assumptions or post-launch fixes, NAB established a repeatable model where every decision could be tested against real customer needs.

By grounding decisions in real customer feedback, NAB reduced risk, accelerated delivery, and ensured every app experience would resonate with customers before launching it.

The integration of UserTesting helped contribute to enterprise-wide results as part of the migration and transformation:

- App store transformation: The first migrated brand, Kogan Money Credit Card, saw its iOS app rating climb from 1.6 to 4.4 stars (and Android from 1.4 to 3.4) after redesigning the app with customer feedback at the core.

- Faster design research and testing: Embedding UserTesting cut cycle times by 60%, saving designers an average of two days per week to focus on higher-value work.

- Scaled consistency across brands: Well-tested and refined experiences were built once and reused across five white-label apps, ensuring efficiency while allowing each brand to retain its unique identity.

- Continuous discovery at scale: With over 200 designers now testing prototypes, NAB operationalized a culture of rapid, customer-driven iteration that supports faster delivery and stronger alignment.

By embedding real customer insight into every stage of design and delivery for Citi’s Australian consumer banking business migration, continuous user insights helped NAB build a foundation for faster innovation, stronger trust, and scalable digital experiences across muliple brands. In partnership with UserTesting, NAB continues to embed customer insight as a strategic driver of innovation and execution. UserTesting is proud to play a role supporting NAB in its ambition to become the most customer-centric company in Australia and New Zealand, helping NAB deliver experiences that drive trust, innovation, and growth—and that customers love to use.

Access to rapid on demand insights has allowed us to differentiate in the moments that matter, helping us back bold, data driven decisions when the pressure was on to deliver.Chris Khalil Head of Design, NAB

Access to continuous insights has been a game changer in our journey. It’s empowered our team to make faster, data-informed decisions that keep our customers at the heart of everything we do.Lance Thornswood Chief Design Officer, NAB