The Labubu hype is real, but it’s not who you think

Why are people going nuts over Labubus? The viral, collectible dolls raked in $418M in revenue for Chinese toy store PopMart, with the most expensive doll selling for $170,000.

We ran a quick pulse survey of 501 consumers in North America to understand what’s fueling the Labubu craze.

Short answer: the aesthetic hooks people, TikTok introduces them, and most buyers are casual—not flippers. Even more interesting: Gen-Z isn’t leading the charge (more on that below!). Here’s what the general population told us.

Key findings:

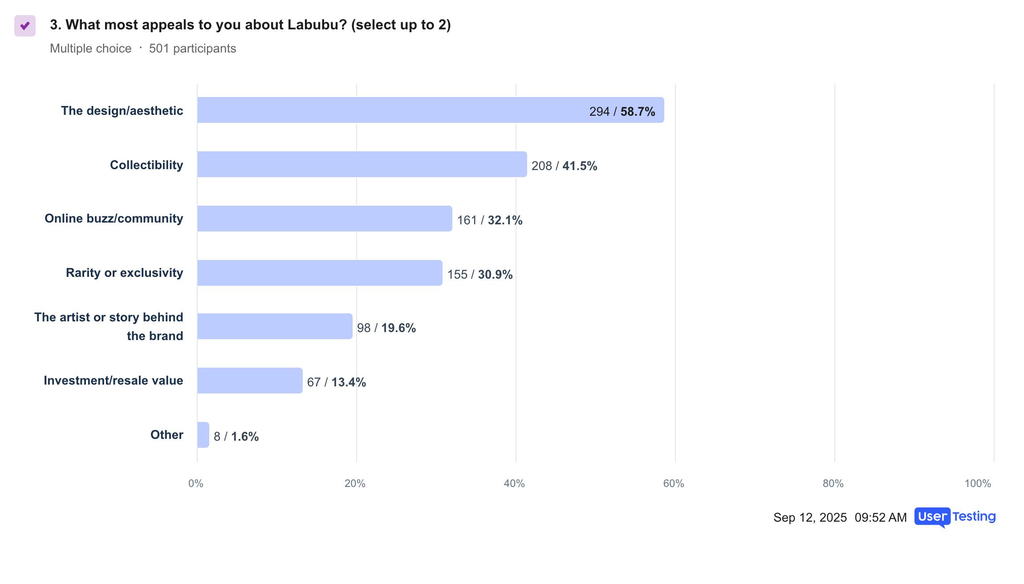

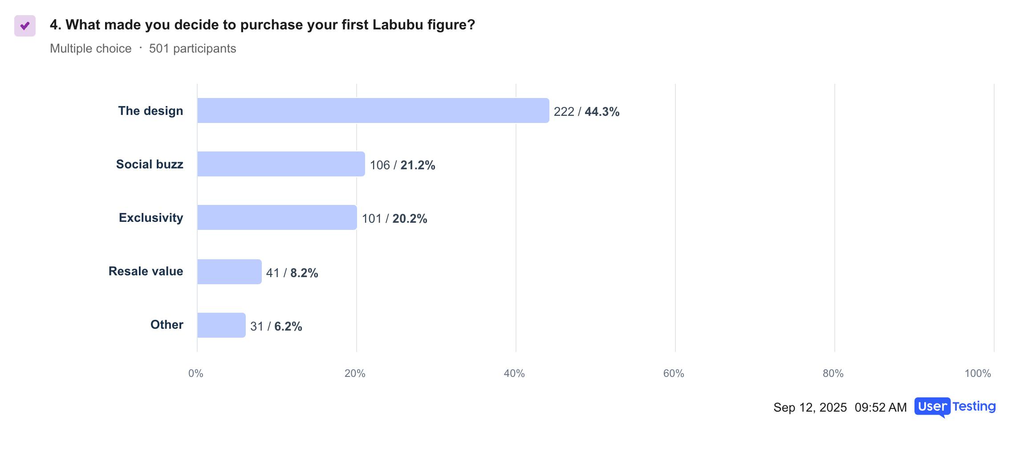

- Design is the engine. It’s the top appeal for both groups (overall 58.7%, Gen-Z 61.4%) and the #1 first-purchase trigger (overall 44.3%, Gen-Z 45.6%).

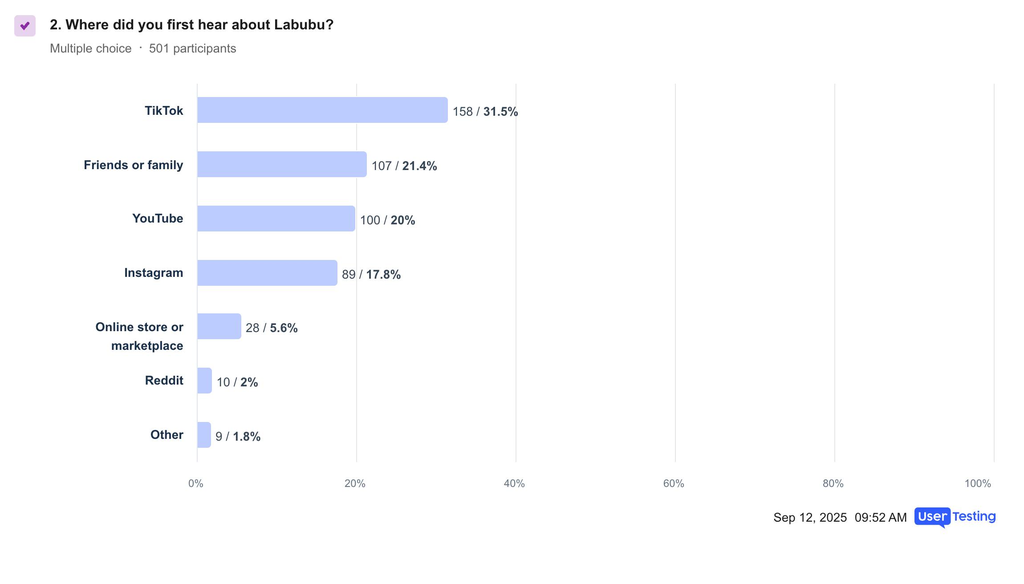

- Gen-Z amplifies awareness, not buying. They discover on TikTok (61.4%)—nearly 2× the general sample (31.5%)—but are less committed buyers: 33.3% report zero figures owned (vs. 21% overall) and only 14% call themselves dedicated collectors (vs. 24.6%).

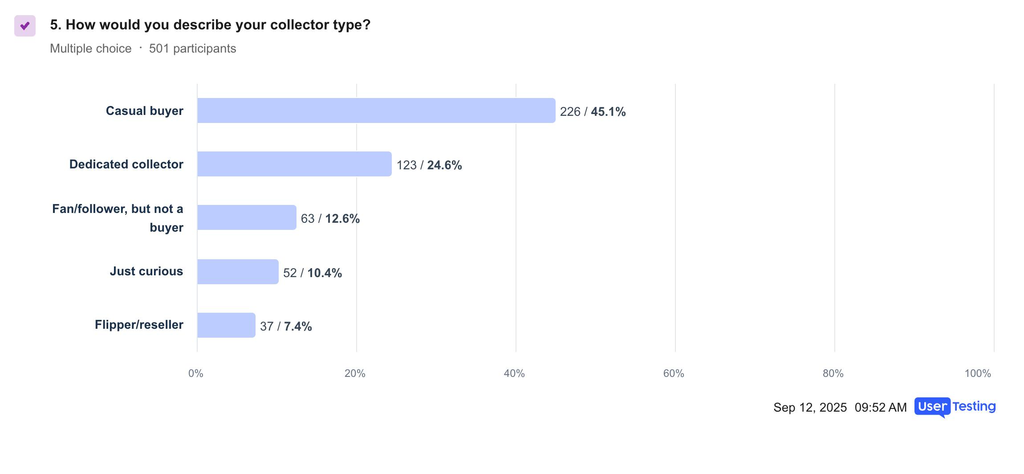

- Adults are doing a lot of the purchasing. The market skews to casual buyers (overall 45.1%; Gen-Z 40.4%), with modest collections (2–5 figures: overall 38.5%, Gen-Z 35.1%).

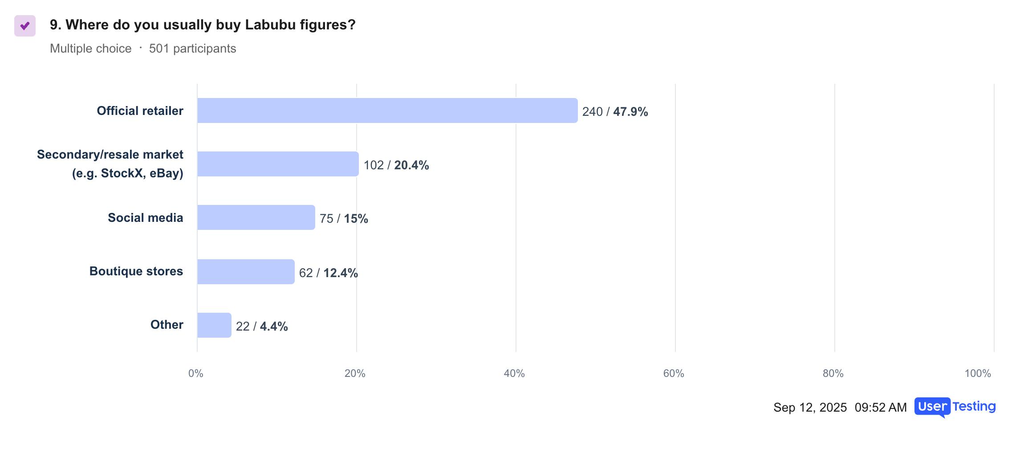

- Where purchases happen. Official retailers lead overall (47.9%), but Gen-Z spreads spend to social commerce (21.1%) and resale (22.8%), with lower brand.com share (33.3%).

- Moments that move people. In the full sample, scoring a drop feels exciting (70.1%) and accomplished (33.9%); for Gen-Z the blind-box “surprise” is loved by 59.6% but some want more control.

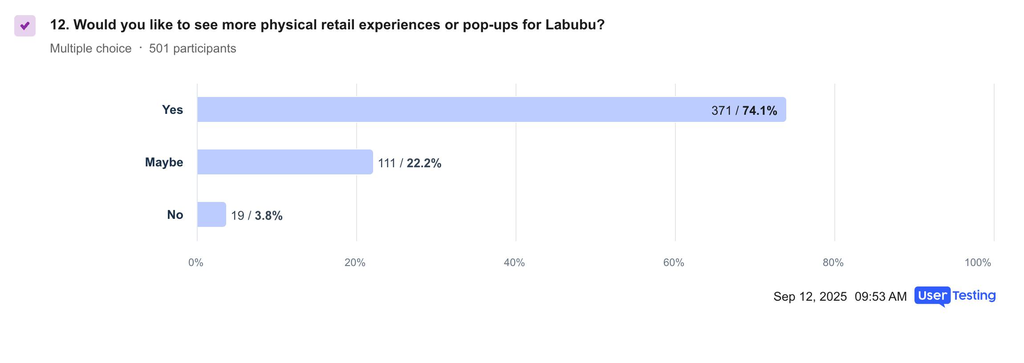

- IRL still matters. Interest in pop-ups is high (overall 74.1%, Gen-Z 68.4%).

Who’s actually fueling the craze

The cultural myth says Gen-Z is driving Labubu. Our data says: they’re the megaphone, not the wallet. Compared to the general population, Gen-Z has more fence-sitters (“just curious” 22.8%) and fewer die-hards (dedicated collectors 14%). Practically, that means a lot of the sales energy likely comes from adults—and often parents—buying for kids.

Design is the engine. Across both groups, the look does the heavy lifting: “design/aesthetic” tops appeal (58.7% overall; 61.4% Gen-Z) and is the leading first-purchase trigger (44.3% overall; 45.6% Gen-Z). In other words, your crisp 360s, in-hand shots, and shelf-styling ideas sell more toys than any lore dump. Make it pretty; make it pop; watch carts grow.

Gen-Z brings the views, not the volume. Discovery skews wildly to TikTok for Gen-Z (61.4%) versus the general sample (31.5%), yet they’re less converted: 33.3% of Gen-Z own zero figures (vs. 21% overall), and only 14% call themselves dedicated collectors (vs. 24.6%). The likely shopper behind the hype? Adults—often parents—quietly adding “just one more” to the gift pile.

Where money changes hands. Overall, official retailers dominate purchases (47.9%), but Gen-Z is channel-fluid: only 33.3% buy via brand sites/stores, while resale (22.8%) and social commerce (21.1%) pull more weight, with boutiques at 14%. Treat TikTok as the front door, but make sure your DTC checkout is irresistible—and keep satellite shelves stocked where Gen-Z actually taps “buy.”

PULSE REPORT

Pulse Report: Retail, Q3 2025

AI gains trust, pricing fears ease, and new loyalty drivers emerge

Scarcity and the thrill factor—use sparingly. Exclusivity moves Gen-Z more than everyone else (about 28% of their first buys vs. ~20% overall), but hype alone rarely seals the deal. Drop culture still packs a punch: roughly 41% have queued and ~10% walked away empty-handed, so the emotional swing is real—about 70% feel a rush when they score. Gen-Z loves the blind-box surprise (~60%), yet many also want a little control (around a quarter call it exciting and frustrating). Aim for choice + chance: keep the mystery, but add pick-your-figure windows, fair queues, and second-chance raffles to sustain joy without the rage-quit.

Who’s collecting—and how much. The base is mostly casual (45.1% overall; 40.4% Gen-Z) with approachable stacks: 2–5 figures is the modal tier (38.5% overall; 35.1% Gen-Z). “Whales” are rare (>20 figures: 1.2% overall; 0% Gen-Z), and flippers are a minority (7.4% overall; 5.3% Gen-Z). Translation: design for repeatable, moderate AOV—bundles, seasonal colorways, milestone rewards.

IRL still matters—bring your camera. Demand for hands-on moments is high: roughly three in four shoppers want more pop-ups (≈74% overall), and even Gen-Z is on board at about two-thirds (≈68%). People want to see the finish and scale up close, snap the pic, and feel like they were there when it dropped. Deliver that with tactile displays and “touch-and-try” bays, creator-ready backdrops for quick reels, and tap-to-pay checkout that gets them from selfie to souvenir in under a minute.

GUIDE

Optimizing conversion rates for retail and consumer brands

Key takeaways for the retail experience executive

Design drives demand. When the product is genuinely beautiful, marketing is an accelerant—not a rescue mission. Invest in aesthetics first; everything else compounds from there.

Gen-Z is the megaphone, not the wallet. Treat them as your awareness engine while building conversion paths for the adults who actually check out—often parents.

Own the relationship. Social video is discovery; your first-party channels are where trust, data, and lifetime value are built. Be present everywhere, but anchor the journey with you.

Scarcity is seasoning. Use exclusivity to create urgency, not dependency. Fairness and transparency are brand assets; protect them.

Design for the “casual majority.” Growth comes from repeatable, moderate purchases—not whales. Lower friction, widen on-ramps, and let collections grow over time.

Blend belonging with buying. IRL moments convert hype into loyalty. Treat events as community builders and content engines, not just sales days.

Balance mystery with agency. The thrill matters, but so does control. Preserve excitement while minimizing regret; goodwill is compounding interest.

Measure what lasts. Shift success metrics from sell-out speed to retention, repeat rate, attachment, and cross-channel lift. That’s the health of the franchise.

GUIDE