The future of banking is omnichannel

The average American has access to more than 10 connected devices in their household, with more than two computers and two mobile phones, according to a Statista survey. With the variety of devices at our disposal, it’s only natural that consumers expect to do a task on any device and receive a consistent experience each time. Add fast-paced lifestyles, and increasing customer needs to the mix, and you get organizations working to make their experiences omnichannel-friendly. While not every organization or retailer is jumping on board, it’s clear that customers are now seeking an omnichannel experience, willing to spend more for it, and offering up their loyalty.

We’ve grown accustomed to the omnichannel process in retail, especially with the buy online, pick up in-store service. And users need the same flexibility in banking. With bank branches closing or reducing their hours at record rates in recent years, consumers have had to work around this trend or even embrace it. Customers want more than one avenue to pay their bills, receive customer support, learn financial education, and open an account. Here’s what you need to know about the future of omnichannel banking.

What are the benefits of omnichannel banking?

While some banks and credit unions are ready to deliver omnichannel experiences, most are in the research phase, with even fewer in the execution stage.

But here’s why the payoff can be significant. McKinsey found that one European bank implementing omnichannel changes saw a consistent sales growth of as high as 20% in two to three years. Other benefits include:

- Diversified revenue: We can’t always predict the next big platform to take off or which will lose popularity. However, offering customers a variety of channels ensures more safety and multiple revenue streams, ensuring you have something to fall back on.

- Customer issues are solved quickly: If a customer has a banking issue late in the day, they’re no longer at the mercy of waiting for their branch to open in the morning. They can dial a call center, talk to a chatbot to be directed to a live agent, or open a discussion in a community forum. And with many banks offering 24-hour support, customer service is as competitive as ever.

- Reduced support or operating costs: Certain self-service functions or AI-powered services tend to come without the potential for human error. Customers can get simple needs or questions addressed by chatbots—without having to escalate to chatting with agents and subsequently avoiding long queues. This option ensures the customer gets their needs met promptly, on their own schedule, while organizations can minimize the traffic to support services, especially if they’re short-staffed.

- More flexibility and options for customers: One customer may prefer checking their account balances on mobile during their morning commute, while another may prefer to sit down with a financial advisor. While no two customers are alike, what you can predict is that they all want freedom of choice.

What makes a great omnichannel experience?

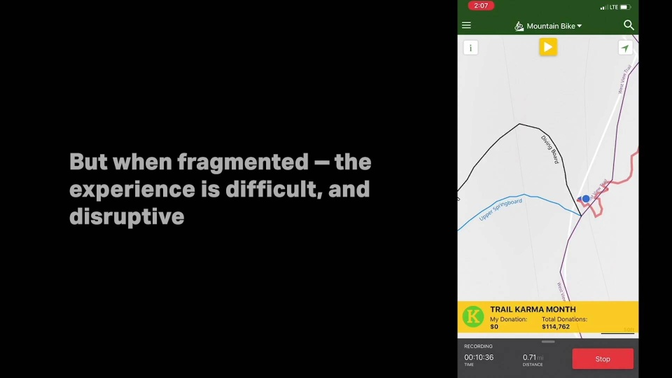

Great omnichannel experiences are seamless, with each channel providing the appropriate tools for the next step. With the inevitably high number of interactions customers will have throughout the experience, these handoffs are especially important for customer retention. A fragmented omnichannel experience results in frustration, evidenced by increased customer service interactions to complete activities, low scores in survey feedback, or even task abandonment.

It’s also critical to be intentional with our touchpoints and ensure they flow seamlessly. Remember—more touchpoints aren’t necessarily better, especially if redundancy or friction points exist.

Rob Krugman, Chief Digital Officer at Broadridge, says, “We’ve overwhelmed people with content. Someone in the physical world may have 20 touchpoints over the course of the year, but in the digital world, we can quickly get to hundreds of touchpoints.” He continues, “What we risk is noise. In the physical world, engagement rates could be near 95%, but in the digital world, they could be 5%. When it comes to communication, how do you bring things together for a story and align with the needs of the customer? If you do it right, less is more, and you’ll be more effective when you implement it.”

Watch the following highlight reel to learn how customers evaluate specific omnichannel experiences.

What are omnichannel studies, and how can you use them for your omnichannel experience?

An omnichannel study is when participants complete an activity that spans more than one channel or device. This type of study is valuable when you want to understand how a single user experiences a brand, company, and organization across touchpoints.

These studies can be conducted at any time, whether you’re introducing or revamping an omnichannel experience. They’re especially valuable when conducted early on, before any redesign efforts. By doing so, researchers can identify what’s working well and what needs to be improved in the existing omnichannel experience.

When leveraging the Human Insight platform, consider the following steps:

- Instruct your test participants to research an item on a smartphone, answer questions, and speak their thoughts aloud throughout each task.

- Ask them to do competitive research on a desktop computer, where it’s easy to switch back and forth between multiple tabs in a browser window.

- Finally, watch them complete checkout on a tablet. Throughout the study, you can ask users to indicate when they would want to switch to a different device and why.

How to conduct better remote omnichannel studies

Target the right touchpoints and areas of opportunity

Start with analytics to find areas of opportunity like bottlenecks, dips in satisfaction, and unexpected behaviors. Then, target those touchpoints associated with the channel where the interaction takes place.

Focus your objectives

Since there are so many touchpoints in the omnichannel journey, it’s easy to make the scope so large that it’s difficult to get meaningful feedback. Instead, plan multiple studies that each focus on different touchpoints in the experience, and ensure your research objectives for each of your studies cover the scope of just that touchpoint.

Create clear tasks and questions

In remote, unmoderated studies, participants need more explicit guidance as they complete tasks so that they don’t get derailed from the primary focus area of the test. It’s recommended to have one question per task instead of multiple.

Find the right people

To keep your omnichannel test consistent, make sure that you have the same people complete each of the objectives in the same order, and make sure all participants have the necessary devices (tablet, mobile phone, etc.) prior to the test. To ensure this, add this requirement as a screener question.

Think through logistics—all of them

It’s critical to ensure that the materials you need to provide to participants for sessions are lined up ahead of launch–and that you haven’t forgotten anything. For instance, if a customer is asked to sign up for an investment account, they’ll need hypothetical payment or financial information that would ideally be pre-filled as they go through the tasks.

Devise a participant communication plan

Think about the timing of sessions and your communication. The testing time is often essential because, especially in physical settings, access to people or facilities, like a bank branch, is not offered 24/7. As a result, it becomes critical how you communicate with study participants ahead of time to set expectations about what they must do—like skipping the remainder of tasks if they can’t move forward for some reason.

Financial services resources

Innovate and optimize financial services experiences with these user experience articles, guides, and usability templates.