Elevate your banking experience with user testing templates

Learning about your customers is a continuous, valuable commitment—especially in the financial services industry. Financial technologies can change overnight, and along with it, customer behavior and habits. Amid uncertain market conditions, inflation, and a cost of living crisis, banking customers rely on financial services more than ever—and expectations are at an all-time high. However, you won’t know what your product lacks if you don’t ask.

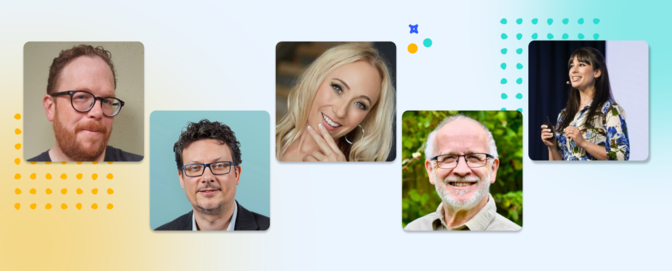

When economic conditions are at a low, you have all the more reason to decipher what your customers are thinking and how your product can best serve them. And even when economic conditions are at a high, by prioritizing user feedback, you’ll be getting ahead of a potential crisis or the next downturn—ensuring you stand out among competitors. Rob Krugman, Chief Digital Officer at Broadridge, says, “As an industry, one of the things we often get caught up on is trying to create experiences based upon our needs. We want to create products and get people to use them.” He continues, “Consumers—they choose to do what they want. If you start with the need of the consumer and work backward, you tend to be in a much better location. It’s about solving the problem even though the customer may not know they have it.”

Whether you’re new to usability testing, need a qualitative research refresh, or are in the thick of convincing your stakeholders of the value of user testing, get started with the following test templates. Fit for any pain point you’re experiencing or yet to discover and made to improve your financial service, there’s a template for any need.

Why use user testing templates?

Test templates are a great way to help teams get comfortable gathering customer insight—and reiterate the value of qualitative research—by providing researcher-approved guidelines to help familiarize your organization with best practices. Complete with sample task questions, user testing templates are also a great way to find inspiration if you’re unsure what to test or how to structure your test.

What can I learn from testing financial experiences?

Uncover how customers evaluate bank communications and landing pages

If you help create great experiences for a retail bank, you’re likely facing increased customer demand for digitization and wavering adoption and retention rates fueled by increasing consumer choice. Solidify customer loyalty and trust by ensuring your messaging hits the mark. Bank communications and landing pages often serve as the first impression of your financial service or the first thing your users see each time they log into their accounts. Ensure your messaging is perceived as intended with the retail banking experiences templates.

Depending on where you’re focusing your efforts, you can ask users to discuss their recent in-person visits to banks, choose between multiple imagery or messaging options, evaluate a landing page, or attempt to complete a prototype.

Sharon Meaney, a Senior User Researcher at Wells Fargo, tells UserTesting, “We’re incorporating more types of studies around language to make that personal connection and not have it feel like there’s a wall of technology between the person and the bank.” She continues, “Sometimes very subtle wording differences around things can make a big difference. Even something like ‘how are you’ versus ‘how’s it going,’ very minute things. Some of our research has found that some of those subtle changes can make people react, ‘that sounds like I’m in trouble’ or ‘no, that sounds like they care.’”

To see user feedback's influence, view the highlight reel below, where retail banking customers discuss if they think their banks understand them.

Learn how customers perceive your bank and the impact of your brand image

Brand identity takes time to build, but the payoff can be customer loyalty and retention. By prioritizing your brand attributes, you’re investing in learning the characteristics and perceptions associated with your product and discovering competitors—some of whom you may not have realized. This step can make all the difference between fostering brand intimacy and a user checking off financial activities as another thing on their to-do list. Consider thinking about what you want your brand to be known for. In a space that’s stereotypically considered boring, stressful, and tedious, you likely want your financial service to be viewed as reassuring, empathetic, innovative, and more.

Whether you’re in the middle of a brand renovation or figuring out for the first time if your organization is well-received, try the brand attributes template. Depending on your focus, you’ll understand how an experience impacts the brand’s perception, the emotions that arise from a logo or image, and what’s needed for a better brand message.

To see user insights in action, watch the following highlight reel for financial services consumer reactions and why they chose to do business with specific brands.

Understand how customers engage with your products across multiple touchpoints

When it comes to financial services, your users could experience dozens of touchpoints before they leave the website or app. From visiting several pages to learn about a new feature or service, talking with a chatbot and eventually a live agent, to signing up for notifications, each step should be optimized so that users can successfully complete tasks and enjoy the overall experience. However, more touchpoints can equate to more opportunities for issues. These problems could be a slow-loading website, long wait times for a live agent, a 404 page, or a problematic navigation bar. To pinpoint any issues before they snowball, leverage the customer journey template.

Whether you’re digging into the customer journey for educational or product development purposes, this template can validate or dispel hypotheses, improve web or mobile design, narrow down priorities, and more.

Uncover friction in your banking app’s usability, appearance, and navigation

According to a 2022 Forbes study, 41% of Americans prefer to do banking via mobile app compared to 37% of those who prefer desktop. This data could partly be explained by financial institutions investing more in the mobile app experience, so much so that it outperforms its website counterpart.

If you haven’t prioritized your mobile experience, this is a sign to start. And if you already have been, remember that your mobile product can continuously be improved, especially as your competitors may offer comparable experiences. The mobile app evaluation template can help your team understand what users think about using your app, highlight areas for improvement, and track trends around loyalty and usage.

To see human insight in motion, watch the below video, where users describe their experience with mobile banking app features and compare their banking app to non-finance services.

Identify opportunities to improve your website’s conversion rates

It takes about .05 seconds for users to form an opinion about your website, according to 8ways. With limited time to make a great first impression, multiple factors must be in sync, including layout, design, navigation, and branding. And with Forbes finding that Americans prefer mobile banking over desktop, your financial service’s website may have some catching up to do. But remember, your mobile and desktop experiences should complement each other instead of compete. While both channels have their benefits, some users may prefer the desktop experience for reading long financial documents, signing up for an account, getting a more in-depth look at bank accounts, and not having to download an app.

The website evaluation template can be customized for your needs, whether you’re testing the usability or navigation elements or observing the ease or difficulty of completing a specific task.

Understand customer needs for reassurance and trust with better data privacy

While consumers may not always read the fine print of their financial service’s data privacy and security protections, they inherently expect that their finances will be safe and accounts will be unbreachable. Over half of consumers reveal that they can't effectively protect their data, primarily because it’s too difficult to understand how organizations are using their data. Therefore, establishing the foundation for consumer trust should begin as early as possible.

Some financial institutions have taken extra measures to protect consumers by requiring frequent password changes or multi-factor authentication—or automatically logging out of accounts after a certain period of inactivity. While the security measures will vary based on the organization, you’ll first need to hone in on a focus area, from how your customers perceive how their data is handled to how they interact with cookies permissions.

Whether your team is creating a new product that requires personal data, or making changes to your existing data privacy strategy, the data privacy templates will help your team gauge your customers’ understanding and comfort levels.

For more templates, or to address a need that wasn’t listed above, visit our template gallery.

Improve digital bank account opening experiences

Innovate and optimize digital banking experiences with this comprehensive onboarding guide.