Solutions

UserTesting for financial services

Create competitive financial services experiences that drive loyalty, trust, and retention

See UserTesting in action

Guide

The future of banking contact centers

Discover key trends shaping the future of banking contact centers and how to improve customer experience.

Adapt and differentiate with UserTesting

How financial services organizations leverage UserTesting

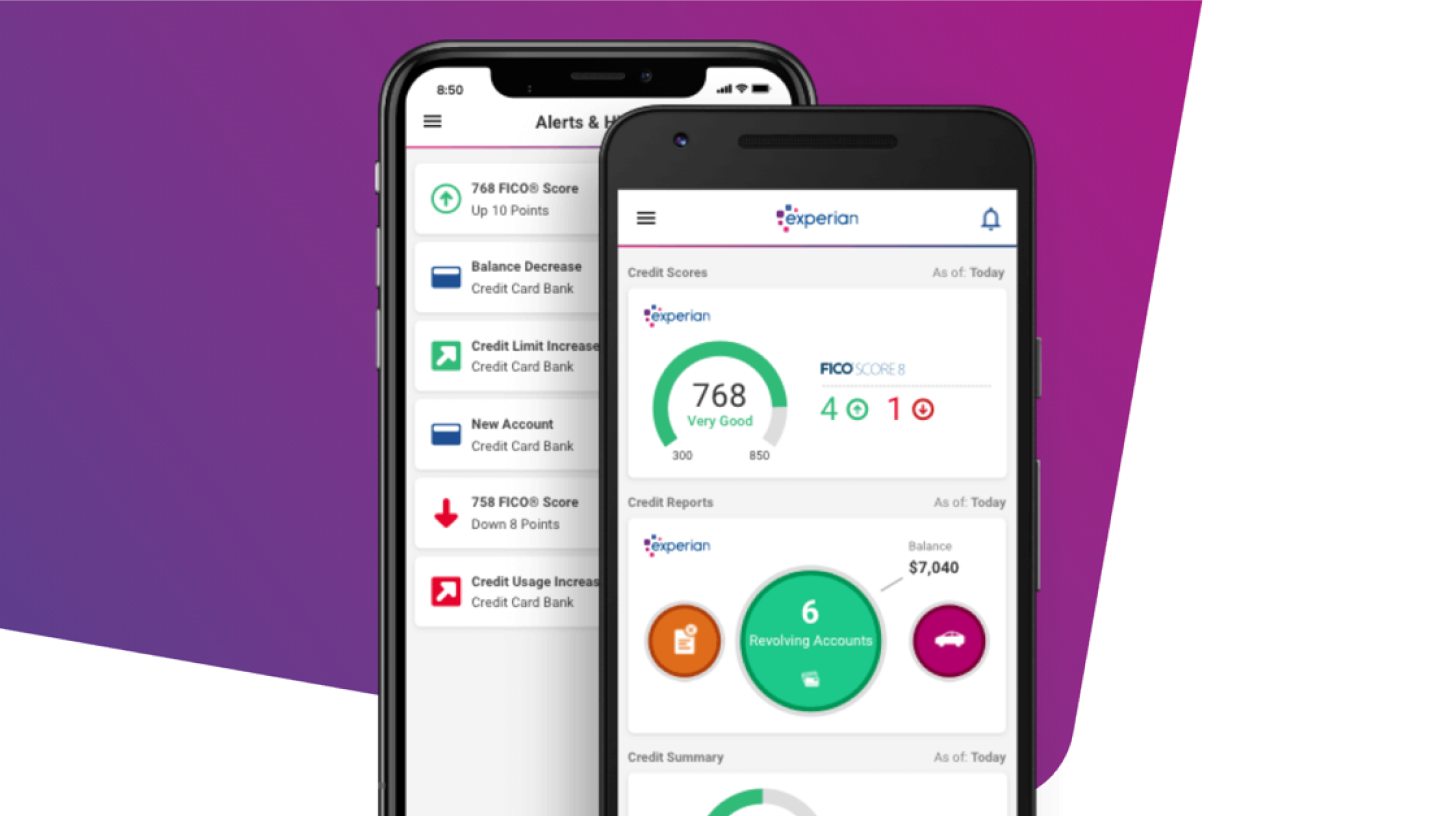

Leverage data analytics to gain insights into customer behavior, preferences, and needs, enabling targeted marketing and personalized product offerings

Gain valuable insights into customer behavior, preferences, and needs, helping FinServe check if they follow consumer-related regulations

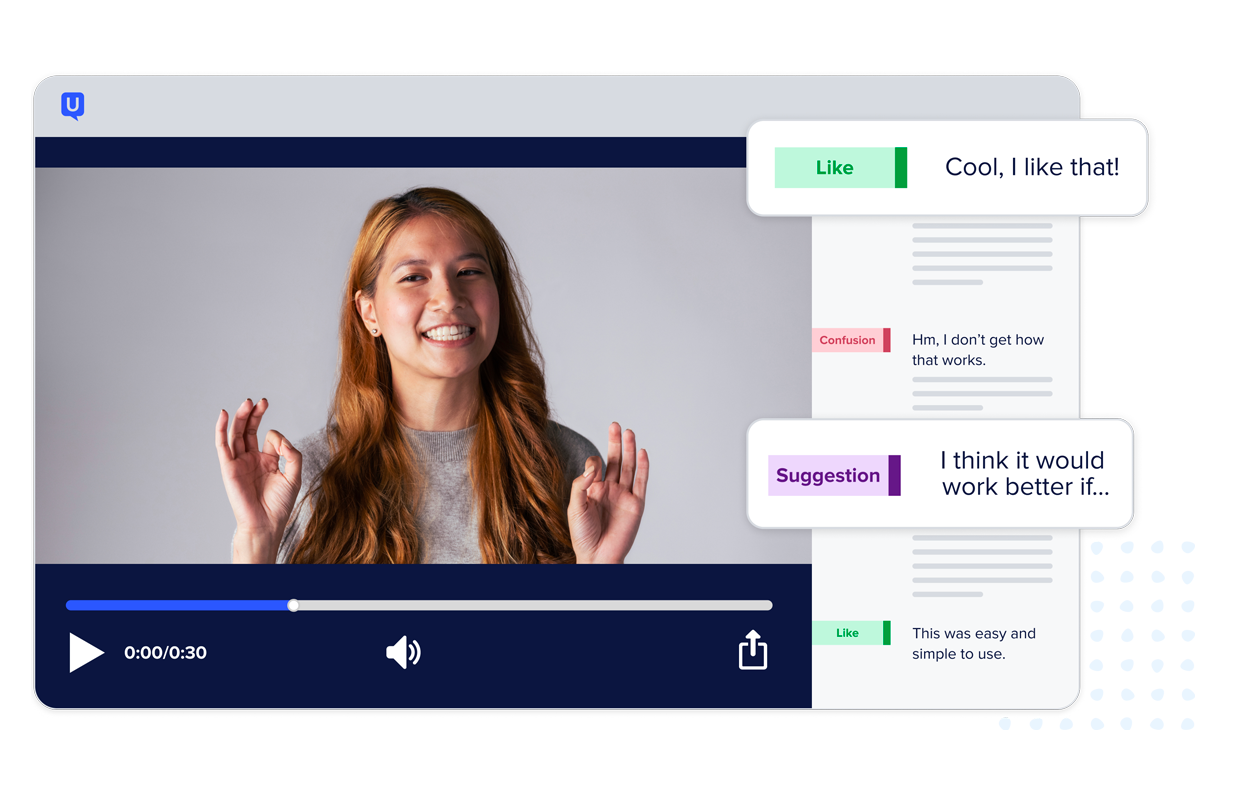

Adopt a customer-centric approach to innovation, address pain points, and design solutions that meet customers' changing needs

Understand first-hand how customers view your company to adjust messaging and campaigns to rebuild your reputation

Understand the frustrations of customers with vision or hearing impairment

Understand customer preferences and seeing firsthand how they interact with products and services to build the right products and create the best content

How our customers earn loyalty and trust with UserTesting

Test templates for financial services experiences

Get started quickly with UserTesting test templates to validate concepts, discover needs, and optimize experiences to drive trust and customer loyalty.

Explore more financial services resources

Start here to explore our curated resources for banking and financial services experiences, including best practices, expert advice, test templates, podcasts, and webinars.

Unlock your customer insight ROI

Discover the hidden ROI of your customers' insights. Book a meeting with our Sales team today to learn more.