Financial services resources

Start here to explore our curated resources for insurance, banking, and financial services experiences, including use cases, guides, best practices, expert advice, test templates, podcasts, and webinars.

Use cases for banking and financial services experiences

Onboarding is crucial in the financial services space, as customers provide sensitive information and expect security and privacy. Users are either clicks away from trusting and successfully adopting your product—or giving up and looking to competitors for a better experience. Check our latest guide to uncover how to optimize and innovate onboarding for digital bank account opening experiences.

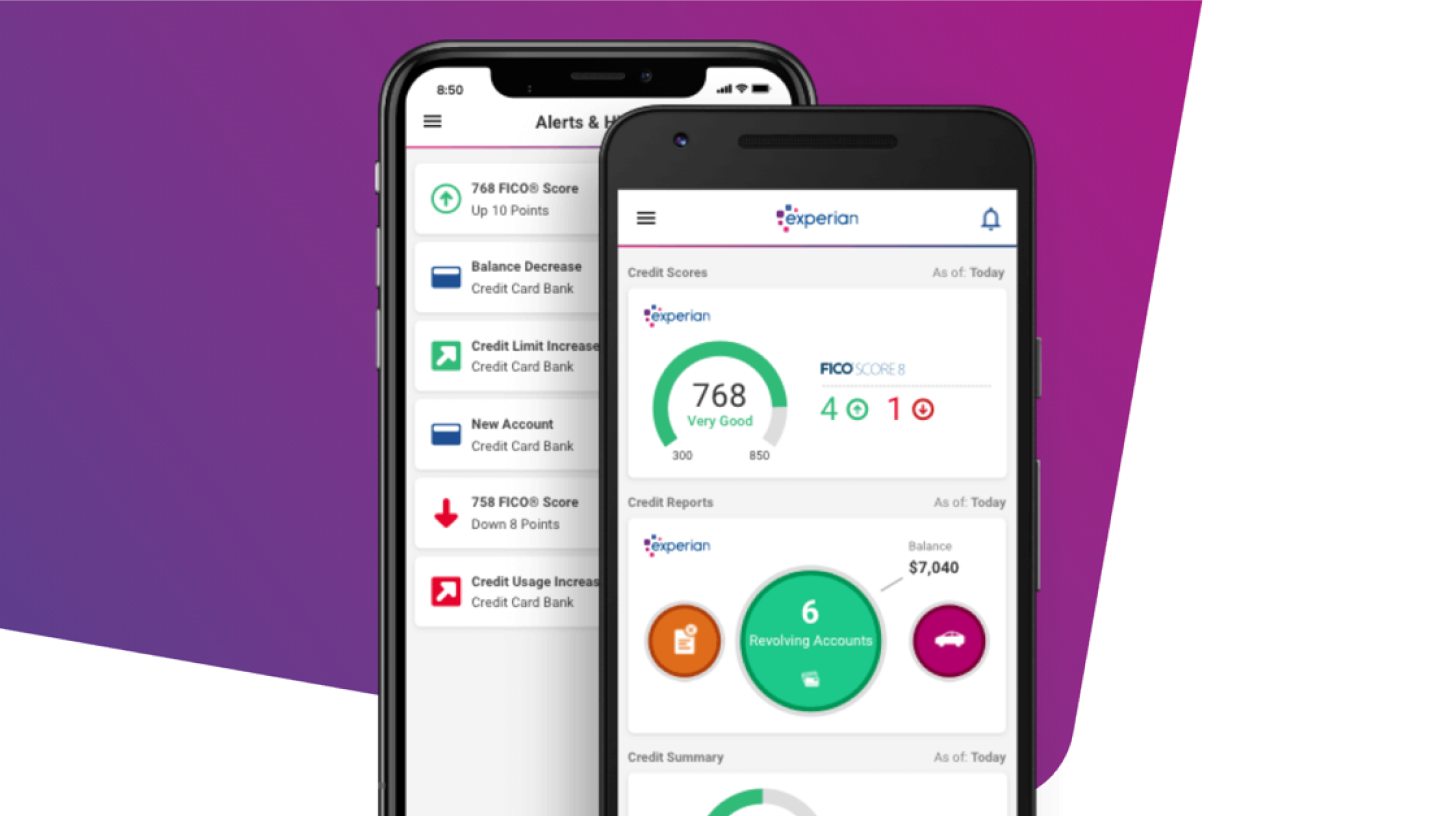

Today’s consumers expect access to their finances anytime, anywhere, across all their devices. If customers struggle to complete transactions or find key information while on the go, these negative experiences can quickly outweigh any positive experiences they’ve had in bank branches. Try our customer journey template to understand how customers interact with your product across all touchpoints and uncover areas for improvement and optimization.

More so than any other industry, privacy and security are top priorities for financial services organizations. Consumers need to be certain that their money is safe and insured, and they want transparency around fees, fraud prevention, and what the institution does with the money. Try our data privacy template to ensure customers trust their financial data with your organization.

From online advertisements to in-branch experiences to chatbot interactions, every touchpoint shapes the consumer’s opinion of your financial services brand. Positive experiences lead to greater loyalty, and negative experiences drive customers to competitors. Try our banking experiences template to gain a holistic view of how your customers perceive your institution.

Webinars for financial services teams

Hear what today’s top financial services experts are saying in these live and on-demand sessions

Pulse Reports

Pulse Report: Financial Services, Q2 2025

In this quarterly Pulse Report, learn more about the rising demand for streamlined digital banking services and the critical need to enhance security measures to address customer concerns about trust and privacy.

Explore popular financial services resources

Report

Comparing the digital experience of the top 5 US banks

Giving customers a great digital experience is a moving goalpost. Just when you think you've nailed it, the bar rises higher. That's why we asked 1,500 digital banking consumers to use the websites of the top five US banks, share their perspectives, and rate their experiences. Check out the report to see how the results show there's still room for improvement.

Customer success stories

Explore the power of human insight across financial services

UserTesting Solutions

Differentiate financial services experiences with UserTesting

Leverage UserTesting's platform and services to create competitive financial services experiences that reduce costs, boost efficiencies, and drive customer loyalty, trust, and retention.

Create great financial services customer experiences

Watch a demo or contact us to discover how UserTesting can help your financial services team.